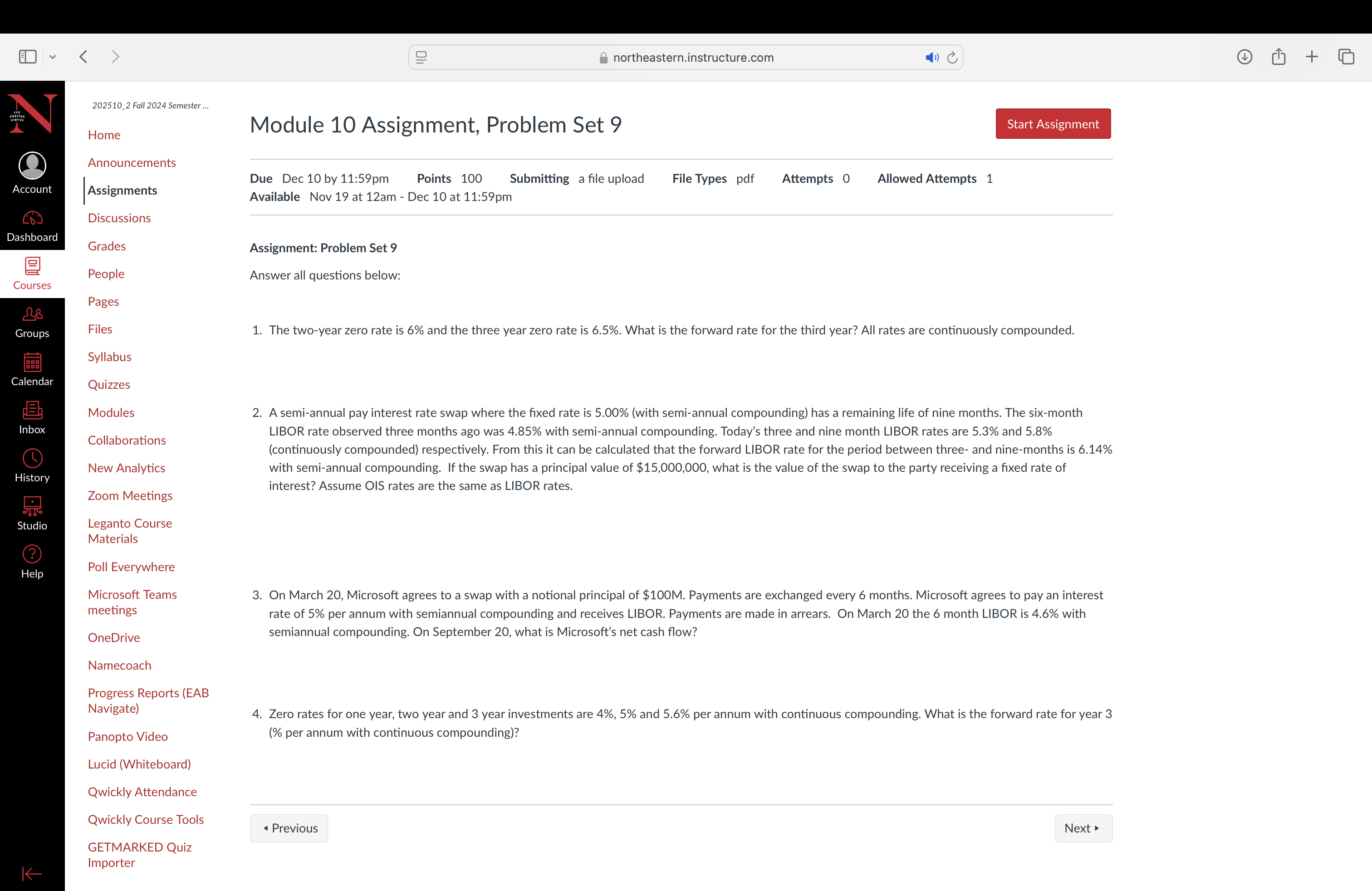

Question: 9 northeastern.instructure.com () C 202510_2 Fall 2024 Semester ... Start Assignment Home Module 10 Assignment, Problem Set 9 Announcements Due Dec 10 by 11:59pm Points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts