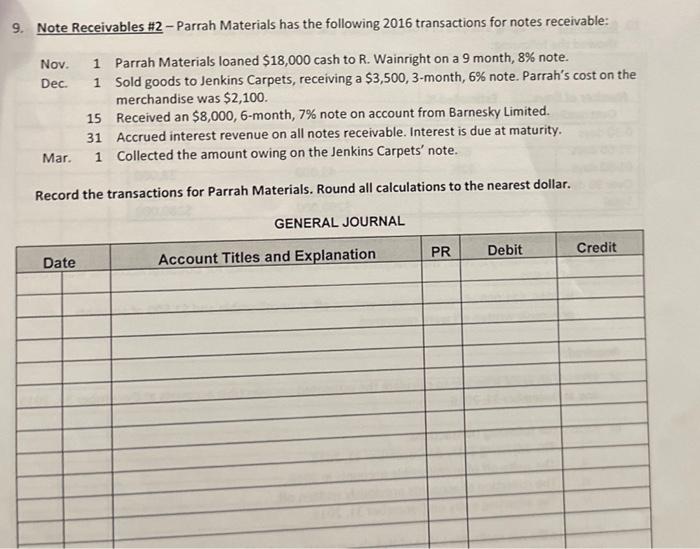

Question: 9. Note Receivables #2 - Parrah Materials has the following 2016 transactions for notes receivable: Nov. 1 Parrah Materials loaned $18,000 cash to R. Wainright

9. Note Receivables \\#2 - Parrah Materials has the following 2016 transactions for notes receivable: Nov. 1 Parrah Materials loaned \\( \\$ 18,000 \\) cash to \\( R \\). Wainright on a 9 month, \8 note. Dec. 1 Sold goods to Jenkins Carpets, receiving a \\( \\$ 3,500,3 \\)-month, \6 note. Parrah's cost on the merchandise was \\( \\$ 2,100 \\). 15 Received an \\( \\$ 8,000,6 \\)-month, \7 note on account from Barnesky Limited. 31 Accrued interest revenue on all notes receivable. Interest is due at maturity. Mar. 1 Collected the amount owing on the Jenkins Carpets' note. Record the transactions for Parrah Materials. Round all calculations to the nearest dollar. GENERAL JOURNAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts