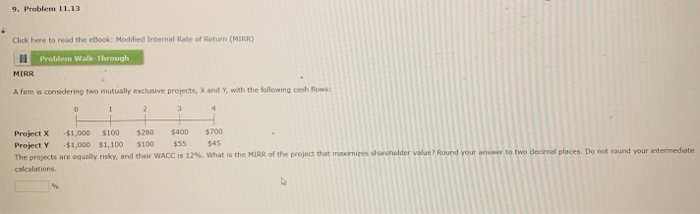

Question: 9. Problem 11.13 Click here to read the book: Modified Internal Rate of Return (MIRR) Problem Walk-Through MIRR A firm is considering two mutually exclusive

9. Problem 11.13 Click here to read the book: Modified Internal Rate of Return (MIRR) Problem Walk-Through MIRR A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 1 3 4 Project X -$1,000 $100 $280 $400 $700 Project Y -$1,000 $1,100 $100 $55 $45 The projects are equally risky, and the WACC is 125. What is the MIRR of the project that maurizes shareholder value Round your answer to two decimal places. Do not found your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts