Question: 9. Problem (2 parts) Consider a 5-year project with the following information. Initial fixed asset investment = $705,000. Straight-line depreciation to zero over the 5-year

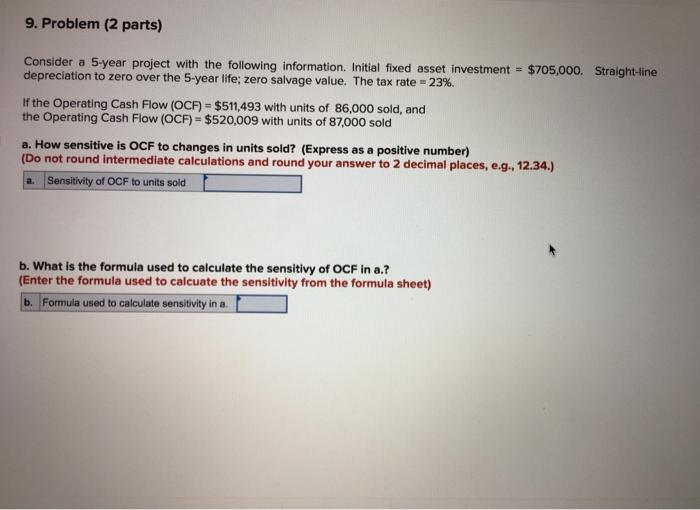

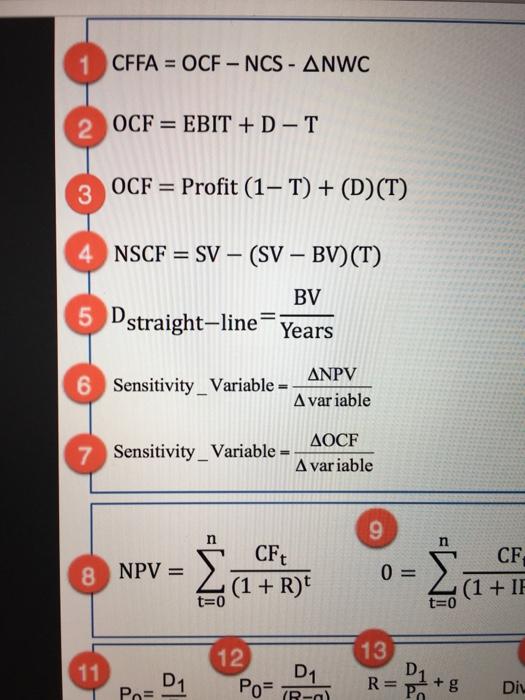

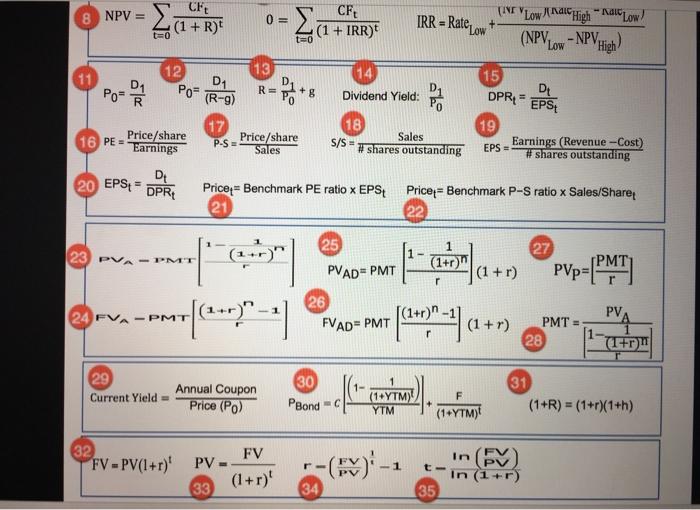

9. Problem (2 parts) Consider a 5-year project with the following information. Initial fixed asset investment = $705,000. Straight-line depreciation to zero over the 5-year life; zero salvage value. The tax rate = 23%. If the Operating Cash Flow (OCF) = $511,493 with units of 86,000 sold, and the Operating Cash Flow (OCF) = $520,009 with units of 87,000 sold a. How sensitive is OCF to changes in units sold? (Express as a positive number) (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) a. Sensitivity of OCF to units sold b. What is the formula used to calculate the sensitivy of OCF in a.? (Enter the formula used to calcuate the sensitivity from the formula sheet) b. Formula used to calculate sensitivity in a 1 CFFA = OCF - NCS - ANWC 2 OCF = EBIT +D-T 3 OCF = Profit (1-T) + (D)(T) 4 NSCF = SV - (SV BV)(T) BV 5 Dstraight-line Years ANPV 6 Sensitivity _Variable = A variable 7 AOCF Sensitivity _ Variable - A variable n n 8 NPV = Za CFt (1 + R) 9 CF 0= (1 + IF t=0 t=0 12 13 11 D1 D1 Po= POF TR-01 D1 R= + g Di CF 8 NPV = (1 + R) t=0 0= CF (1 + IRR) IRR = Rate.com LOW + CINE Y Low (NIC High AIEL (NPV-NPV, Low High t=0 13 11 D1 12 Po D1 (R-9) R 8 Dividend Yield: 15 DE DPR = EPS 19 Earnings (Revenue -Cost) EPS #shares outstanding 17 P-s - Price/share 18 Sales S/S - #shares outstanding Sales 16 PE = Price/share Earnings DE 20 EPS = DPR Price = Benchmark PE ratio x EPS 21 Price = Benchmark P-S ratio x Sales/Share 22 25 27 23 PVA-PMT ] (1+r) PVAD= PMT (1 + r) PVP=[PMT) r 26 24 PMT -[(4-1)-4 PV FVAD= PMT [(147)* +44 (1+r) PMT = 28 (1+r) 29 Current Yield 30 Annual Coupon Price (Po) F 31 (1+R) = (1+r)(1+h) (1+YTM) YTM PBond - (1+YTM) 32 FV = PV(1+r) PV - FV 33 (1+r)' --(FM)-1 In (FM) t-in (1+r) 34 (35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts