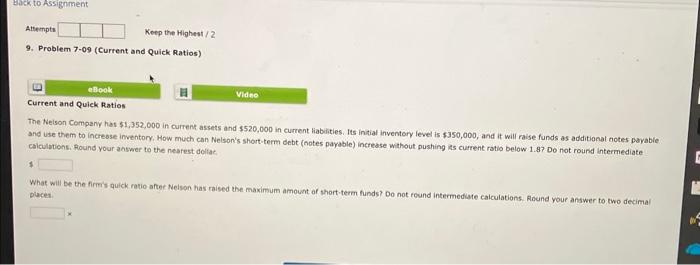

Question: 9. Problem 709 (Current and Quick Ratios) Current and Quiek Ratios The Neison Company has $1,352,000 in current assets and $520,000 in current liabilities. Its

9. Problem 709 (Current and Quick Ratios) Current and Quiek Ratios The Neison Company has $1,352,000 in current assets and $520,000 in current liabilities. Its initial inventory level is $350,000, and it will raise funds as additionat ootes payable and use them to increase inventory, How much can Nelson's short-tem debt (notes payable) increase without pushing its current ratio below 1.8 ? Do not round intermediate calculations. Flound your answer to the nearest doliac 1 What will be the firms quick ratio after Nelson has raised the maximum amount of thort-term funds? Do not round intermediste calculations. Flound your answer to two decima places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts