Question: (9 pts) 1. When deciding whether to issue debt or equity, discuss the factors that would favor issuing debt. (3 pts) 2. Suppose you signed

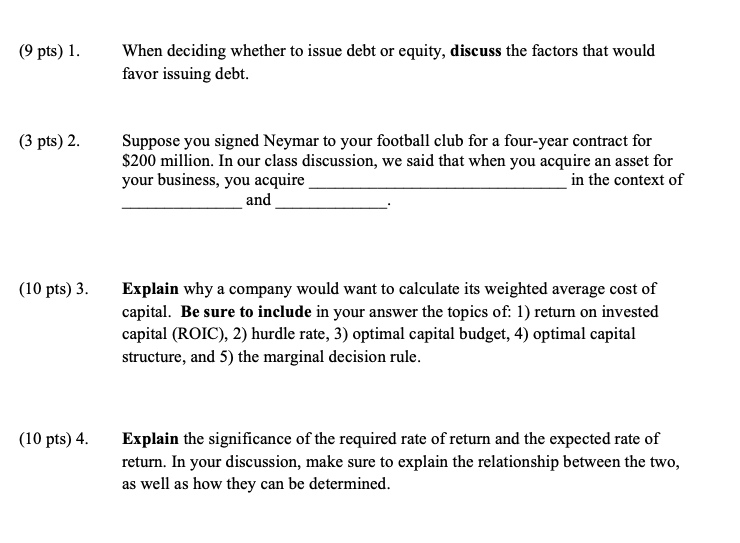

(9 pts) 1. When deciding whether to issue debt or equity, discuss the factors that would favor issuing debt. (3 pts) 2. Suppose you signed Neymar to your football club for a four-year contract for $200 million. In our class discussion, we said that when you acquire an asset for your business, you acquire in the context of and (10 pts) 3. Explain why a company would want to calculate its weighted average cost of capital. Be sure to include in your answer the topics of: 1) return on invested capital (ROIC), 2) hurdle rate, 3) optimal capital budget, 4) optimal capital structure, and 5) the marginal decision rule. (10 pts) 4. Explain the significance of the required rate of return and the expected rate of return. In your discussion, make sure to explain the relationship between the two, as well as how they can be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts