Question: 9. Put-call parity and the value of a put option Consider two portfolios A and B. At the expiration date, t, both portfolios have identical

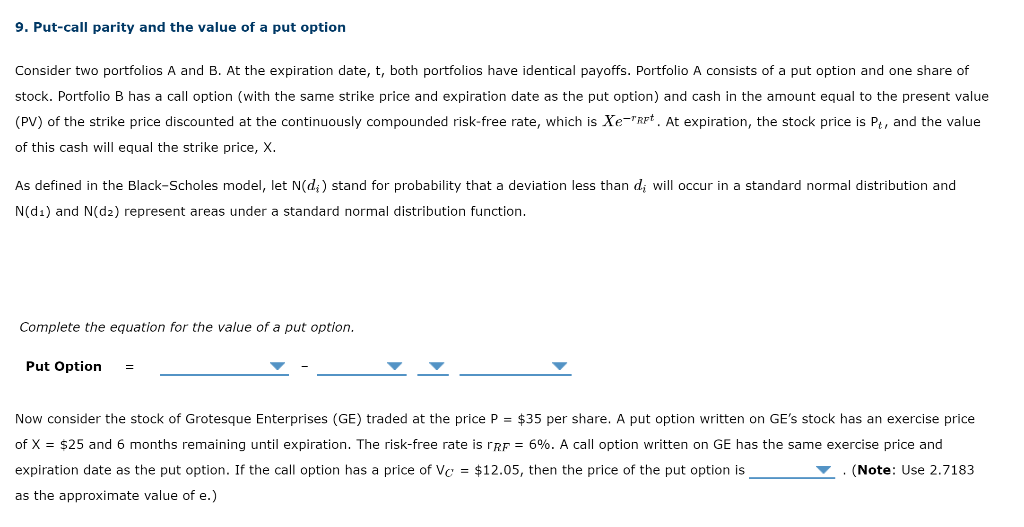

9. Put-call parity and the value of a put option Consider two portfolios A and B. At the expiration date, t, both portfolios have identical payoffs. Portfolio A consists of a put option and one share of stock. Portfolio B has a call option (with the same strike price and expiration date as the put option) and cash in the amount equal to the present value (PV) of the strike price discounted at the continuously compounded risk-free rate, which is Xe-RFt. At expiration, the stock price is Pt, and the value of this cash will equal the strike price, X. As defined in the Black-Scholes model, let N(d;) stand for probability that a deviation less than di will occur in a standard normal distribution and N(D1) and N(dz) represent areas under a standard normal distribution function. Complete the equation for the value of a put option. Put Option = Now consider the stock of Grotesque Enterprises (GE) traded at the price P = $35 per share. A put option written on GE's stock has exercise price of X = $25 and 6 months remaining until expiration. The risk-free rate is TRF = 6%. A call option written on GE has the same exercise price and expiration date as the put option. If the call option has a price of Vc = $12.05, then the price of the put option is (Note: Use 2.7183 as the approximate value of e.) 9. Put-call parity and the value of a put option Consider two portfolios A and B. At the expiration date, t, both portfolios have identical payoffs. Portfolio A consists of a put option and one share of stock. Portfolio B has a call option (with the same strike price and expiration date as the put option) and cash in the amount equal to the present value (PV) of the strike price discounted at the continuously compounded risk-free rate, which is Xe-RFt. At expiration, the stock price is Pt, and the value of this cash will equal the strike price, X. As defined in the Black-Scholes model, let N(d;) stand for probability that a deviation less than di will occur in a standard normal distribution and N(D1) and N(dz) represent areas under a standard normal distribution function. Complete the equation for the value of a put option. Put Option = Now consider the stock of Grotesque Enterprises (GE) traded at the price P = $35 per share. A put option written on GE's stock has exercise price of X = $25 and 6 months remaining until expiration. The risk-free rate is TRF = 6%. A call option written on GE has the same exercise price and expiration date as the put option. If the call option has a price of Vc = $12.05, then the price of the put option is (Note: Use 2.7183 as the approximate value of e.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts