Question: 9. StuartCo is now considering two independent projects utilizing the internal rate of return technique. Project A has an initial investment of $120,000 and cash

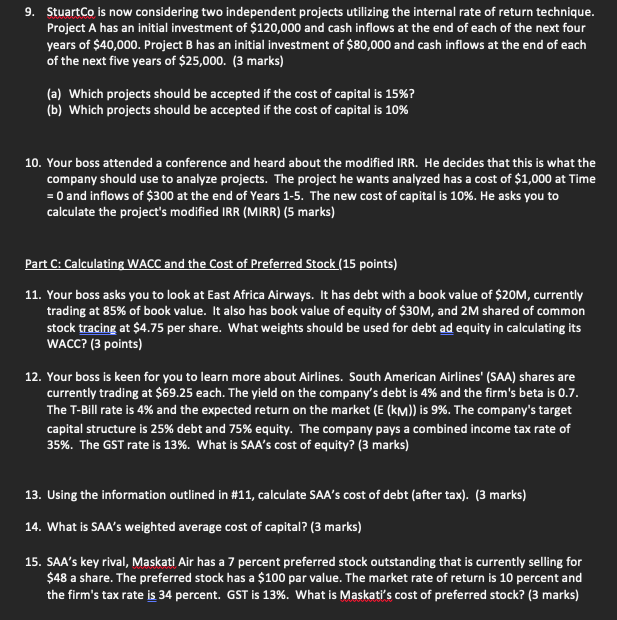

9. StuartCo is now considering two independent projects utilizing the internal rate of return technique. Project A has an initial investment of $120,000 and cash inflows at the end of each of the next four years of $40,000. Project B has an initial investment of $80,000 and cash inflows at the end oach of the next five years of $25,000. ( 3 marks) (a) Which projects should be accepted if the cost of capital is 15% ? (b) Which projects should be accepted if the cost of capital is 10% 10. Your boss attended a conference and heard about the modified IRR. He decides that this is what the company should use to analyze projects. The project he wants analyzed has a cost of $1,000 at Time =0 and inflows of $300 at the end of Years 15. The new cost of capital is 10%. He asks you to calculate the project's modified IRR (MIRR) (5 marks) Part C: Calculating WACC and the Cost of Preferred Stock (15 points) 11. Your boss asks you to look at East Africa Airways. It has debt with a book value of $20M, currently trading at 85% of book value. It also has book value of equity of $30M, and 2M shared of common stock tracing at $4.75 per share. What weights should be used for debt ad equity in calculating its WACC? (3 points) 12. Your boss is keen for you to learn more about Airlines. South American Airlines' (SAA) shares are currently trading at $69.25 each. The yield on the company's debt is 4% and the firm's beta is 0.7 . The T-Bill rate is 4% and the expected return on the market (E ( kM) ) is 9%. The company's target capital structure is 25% debt and 75% equity. The company pays a combined income tax rate of 35%. The GST rate is 13%. What is SAA's cost of equity? ( 3 marks) 13. Using the information outlined in \#11, calculate SAA's cost of debt (after tax). (3 marks) 14. What is SAA's weighted average cost of capital? ( 3 marks) 15. SAA's key rival, Maskati Air has a 7 percent preferred stock outstanding that is currently selling for $48 a share. The preferred stock has a $100 par value. The market rate of return is 10 percent and the firm's tax rate is 34 percent. GST is 13%. What is Maskati's cost of preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts