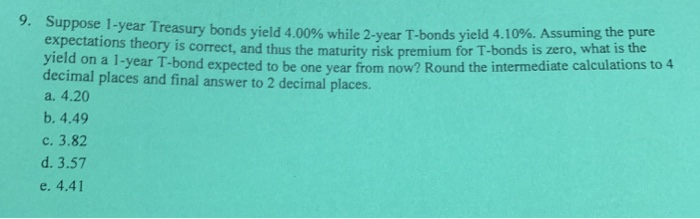

Question: 9. Suppose 1-year Treasury bonds yield 4.00% while 2-year T-bonds yield 4.10%. Assuming the pure expectations theory is correct, and thus the maturity risk premium

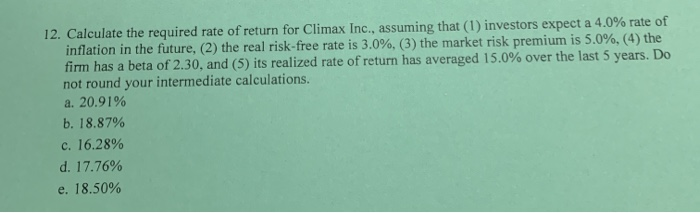

9. Suppose 1-year Treasury bonds yield 4.00% while 2-year T-bonds yield 4.10%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero, what is the yield on a 1-year T-bond expected to be one vear from now? Round the intermediate calculations to 4 decimal places and final answer to 2 decimal places. a. 4.20 b. 4.49 c. 3.82 d. 3.57 e. 4.41 12. Calculate the required rate of return for Climax Inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. Do not round your intermediate calculations. a. 20.91% b. 18.87% c. 16.28% d. 17.76% e. 18.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts