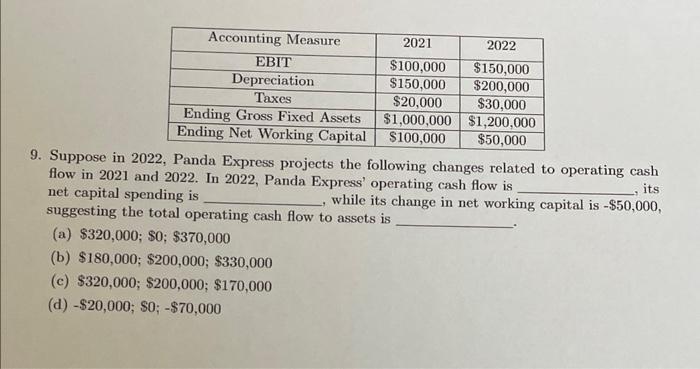

Question: 9. Suppose in 2022, Panda Express projects the following changes related to operating cash flow in 2021 and 2022. In 2022, Panda Express' operating cash

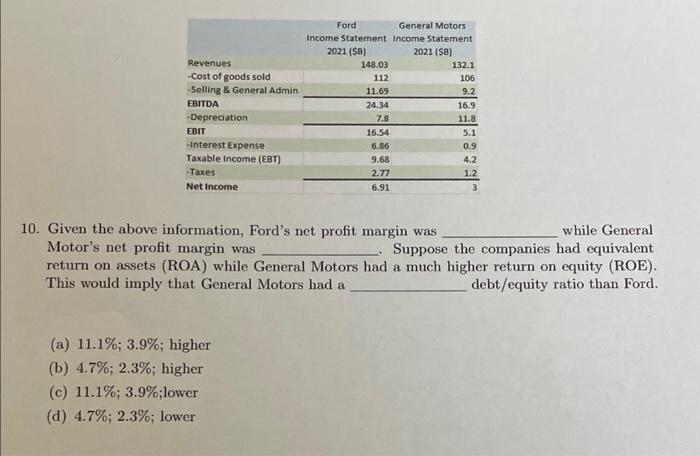

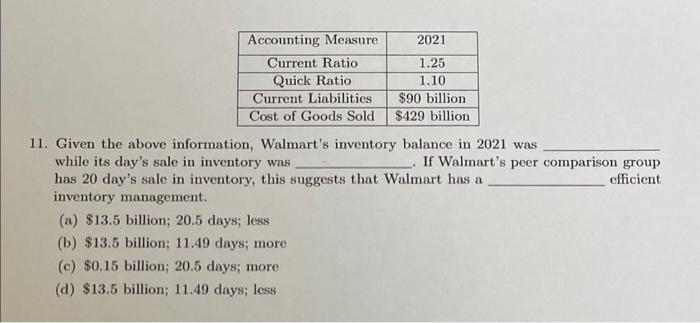

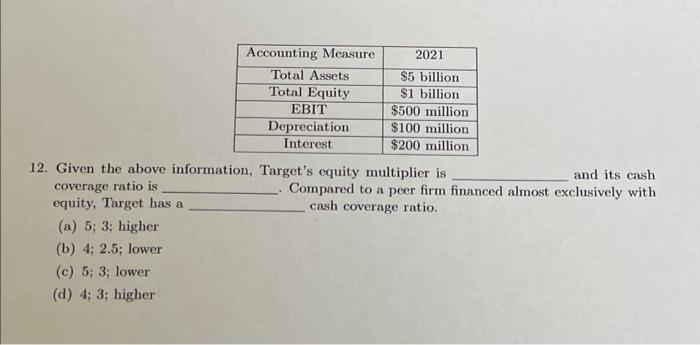

9. Suppose in 2022, Panda Express projects the following changes related to operating cash flow in 2021 and 2022. In 2022, Panda Express' operating cash flow is net capital spending is , while its change in net working capital is $50,000, suggesting the total operating cash flow to assets is (a) $320,000;$0;$370,000 (b) $180,000;$200,000;$330,000 (c) $320,000;$200,000;$170,000 (d) $20,000;$0;$70,000 0. Given the above information, Ford's net profit margin was while General Motor's net profit margin was Suppose the companies had equivalent return on assets (ROA) while General Motors had a much higher return on equity (ROE). This would imply that General Motors had a debt/equity ratio than Ford. (a) 11.1%;3.9%; higher (b) 4.7%;2.3%; higher (c) 11.1%;3.9%; lower (d) 4.7%;2.3%; lower 11. Given the above information, Walmart's inventory balance in 2021 was while its day's sale in inventory was If Walmart's peer comparison group has 20 day's sale in inventory, this suggests that Walmart has a efficient inventory management. (a) $13.5 billion; 20.5 days; less (b) $13.5 billion; 11.49 days; more (c) $0.15 billion; 20.5 days; more (d) $13.5 billion; 11.49 days; less 2. Given the above information, Target's equity multiplier is and its cash coverage ratio is Compared to a peer firm financed almost exclusively with equity, Target has a cash coverage ratio. (a) 5 ; 3; higher (b) 4;2.5; lower (c) 5 ; 3; lower (d) 4; 3; higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts