Question: 9. Suppose two projects A and B each require an initial outlay of $1 10 and the appropriate cost of capital for both projects (or

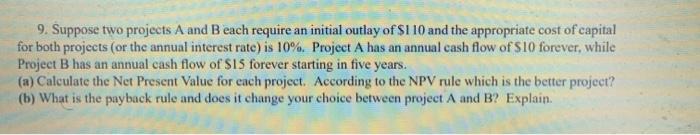

9. Suppose two projects A and B each require an initial outlay of $1 10 and the appropriate cost of capital for both projects (or the annual interest rate) is 10%. Project A has an annual cash flow of S10 forever, while Project B has an annual cash flow of $15 forever starting in five years. (a) Calculate the Net Present Value for each project. According to the NPV rule which is the better project? (b) What is the payback rule and does it change your choice between project A and B? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts