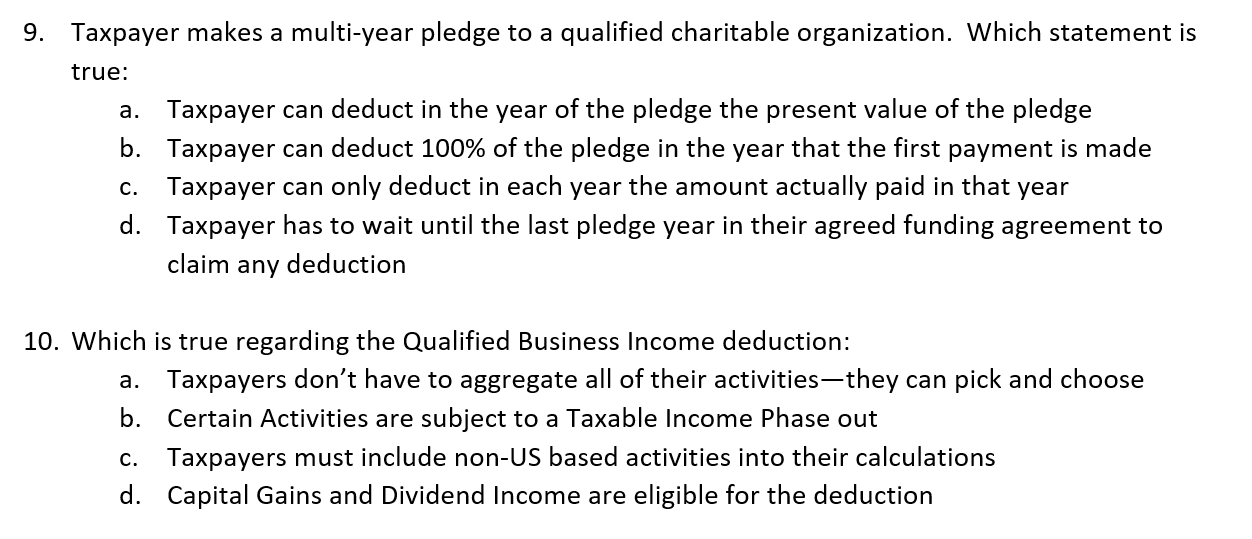

Question: 9. Taxpayer makes a multi-year pledge to a qualified charitable organization. Which statement is true: a. Taxpayer can deduct in the year of the pledge

9. Taxpayer makes a multi-year pledge to a qualified charitable organization. Which statement is true: a. Taxpayer can deduct in the year of the pledge the present value of the pledge b. Taxpayer can deduct 100% of the pledge in the year that the first payment is made C. Taxpayer can only deduct in each year the amount actually paid in that year d. Taxpayer has to wait until the last pledge year in their agreed funding agreement to claim any deduction 10. Which is true regarding the Qualified Business Income deduction: a. Taxpayers don't have to aggregate all of their activities, they can pick and choose b. Certain Activities are subject to a Taxable Income Phase out C. Taxpayers must include non-US based activities into their calculations d. Capital Gains and Dividend Income are eligible for the deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts