Question: 9. The beta coefficient Aa Aa risk. According to A stock's contribution to the market risk of a well-diversified portfolio is called the Capital Asset

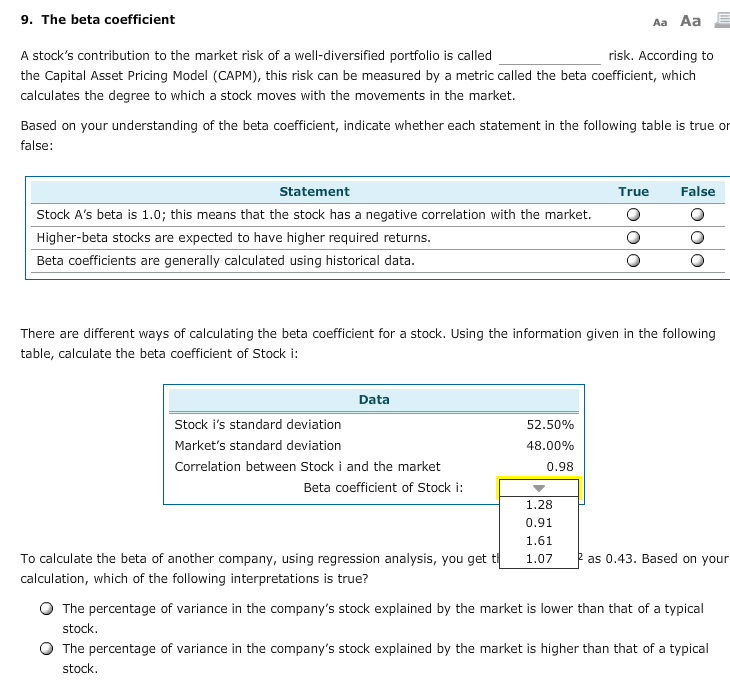

9. The beta coefficient Aa Aa risk. According to A stock's contribution to the market risk of a well-diversified portfolio is called the Capital Asset Pricing Model (CAPM), this risk can be measured by a metric called the beta coefficient, which calculates the degree to which a stock moves with the movements in the market. Based on your understanding of the beta coefficient, indicate whether each statement in the following table is true on false: False Statement True Stock A's beta is 1.0; this means that the stock has a negative correlation with the market Higher-beta stocks are expected to have higher required returns. Beta coefficients are generally calculated using historical data. There are different ways of calculating the beta coefficient for a stock. Using the information given in the following table, calculate the beta coefficient of Stock i Data Stock i's standard deviation 52.50% 48.00 % Market's standard deviation Correlation between Stock i and the market 0.98 Beta coefficient of Stock i 1.28 0.91 1.61 To calculate the beta of another company, using regression analysis, you get t calculation, which of the following interpretations is true? 2 as 0.43. Based on your 1.07 The percentage of variance in the company's stock explained by the market is lower than that of a typical stock The percentage of variance in the company's stock explained by the market is higher than that of a typical stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts