Question: 9. The data below concerns adjustments to be made at the Conner Company. Record the adjusting entries on a general journal as of December

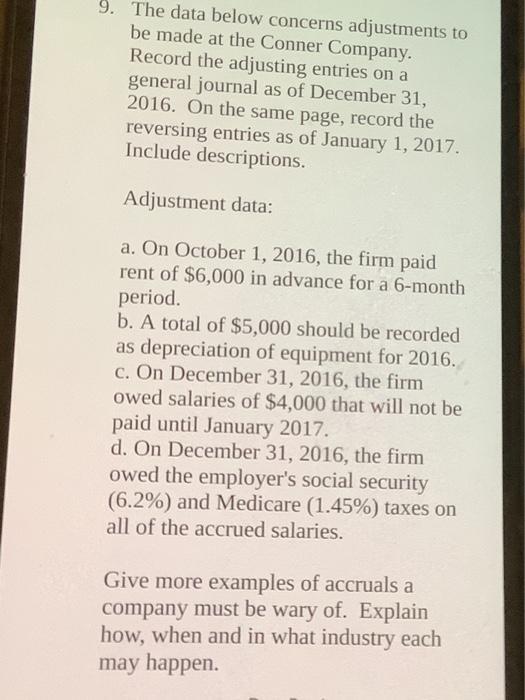

9. The data below concerns adjustments to be made at the Conner Company. Record the adjusting entries on a general journal as of December 31, 2016. On the same page, record the reversing entries as of January 1, 2017. Include descriptions. Adjustment data: a. On October 1, 2016, the firm paid rent of $6,000 in advance for a 6-month period. b. A total of $5,000 should be recorded as depreciation of equipment for 2016. C. On December 31, 2016, the firm owed salaries of $4,000 that will not be paid until January 2017. d. On December 31, 2016, the firm owed the employer's social security (6.2%) and Medicare (1.45%) taxes on all of the accrued salaries. Give more examples of accruals a company must be wary of. Explain how, when and in what industry each may happen.

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

9 SL No Date General Journal Debit Credit 3000 60006 months 3 months 3000 Dec 31 Rent expense a Prep... View full answer

Get step-by-step solutions from verified subject matter experts