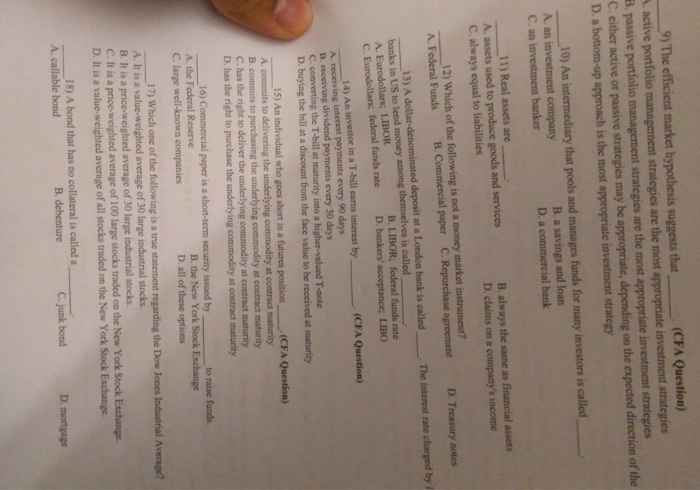

Question: 9) The efficient market hypothesis suggests that (CFA Question) active portfolio management strategies are the most appropriate investment strategies B. passive portfolio management strategies are

9) The efficient market hypothesis suggests that (CFA Question) active portfolio management strategies are the most appropriate investment strategies B. passive portfolio management strategies are the most appropriate investment strategies C. either active or passive strategies may be appropriate, depending on the expected direction of the D. a bottom-up approach is the most appropriate investment strategy 10) An intermediary that pools and manages funds for many investors is called A an investment company C. an investment banker B a savings and loan D. a commercial bank 11) Real assets are B. always the same as financial assets A. assets used to produce goods and services C. always equal to liabilities A. Federal Funds B. Commercial paper C. Repurchase agreement banks in US to lend money among themselves is called on a 12) Which of the following is not a money market instrument? D. Treasury notes 13) A ed deposit at a London bank is called The interest rate charged by l C. Eurodollars; federal funds rate D. bankers' acceptance; LIBO 14) An investor in a T-bill eams interest by (CFA Question) payments every 90 days payments every 30 days the T-bill at maturity into a T-note D. buying the bill at a discount from the face value to be received at maturity 15) An individual who goes short in a futures position C. has the right to deliver the underlying commodity at contract maturity 16) Commercial paper is a short-term security issued by A. commits to delivering the underlying B. commits to purchasing the at contract maturity ty at contract maturity D has the right to purchase the underlying y at contract maturity to raise funds. A. the Federal Reserve C. large well-known companies D. all of these options 17) Which one of the following is a true statement A. It is a value-weighted average of 30 large industrial stocks B. It is a price-weighted average of 30 large industrial stocks. C. It is a price-weighted average of 100 large stocks traded on the New York Stock D. It is a value-weighted average of all stocks traded on the New York Stock Exchange 18) A bond that has no collateral is called a B. debenture C. junk bond D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts