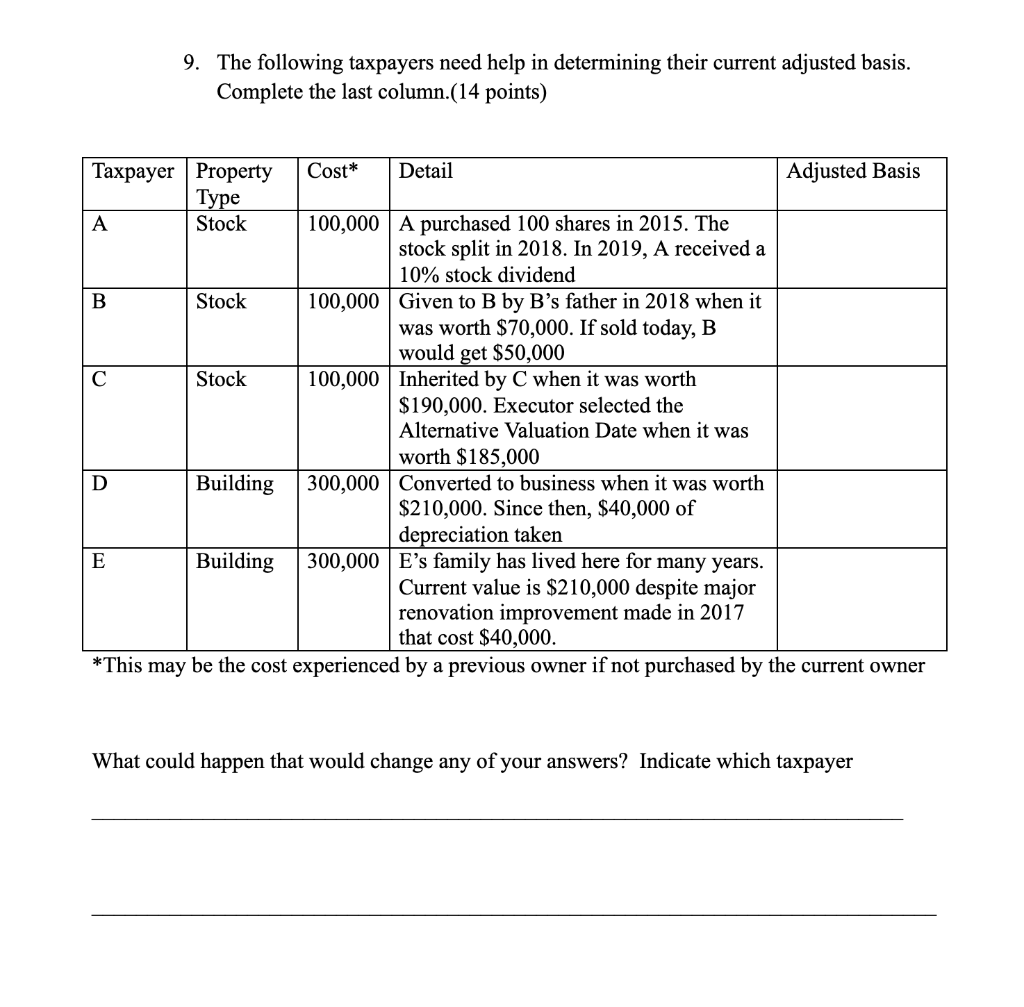

Question: 9. The following taxpayers need help in determining their current adjusted basis. Complete the last column.(14 points) er Proerty Stock Cost* Detail Adjusted Basis

9. The following taxpayers need help in determining their current adjusted basis. Complete the last column.(14 points) er Proerty Stock Cost* Detail Adjusted Basis 100,000 | A purchased 100 shares in 2015. The stock split in 2018. In 2019, A received a 10% stock dividend 100,000 | Given to B by B's father in 2018 when it was worth $70,000. If sold today, B would get $50,000 100,000 | Inherited by C when it was worth $190,000. Executor selected the Alternative Valuation Date when it was A Stock C Stock worth $185,000 300,000 Converted to business when it was worth $210,000. Since then, $40,000 of depreciation taken 300,000 | E's family has lived here for many years. Current value is $210,000 despite major renovation improvement made in 2017 that cost $40,000. *This may be the cost experienced by a previous owner if not purchased by the current owner Building E Building What could happen that would change any of your answers? Indicate which taxpayer

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

ANSWER Tax Payer Adjusted Basis A 100000 B 100000 C 100000 D 2... View full answer

Get step-by-step solutions from verified subject matter experts