Question: 9. The table below shows settlement prices for the S&P 500EMini futures index. Indexes are unique in that the price remains fixed, but the index

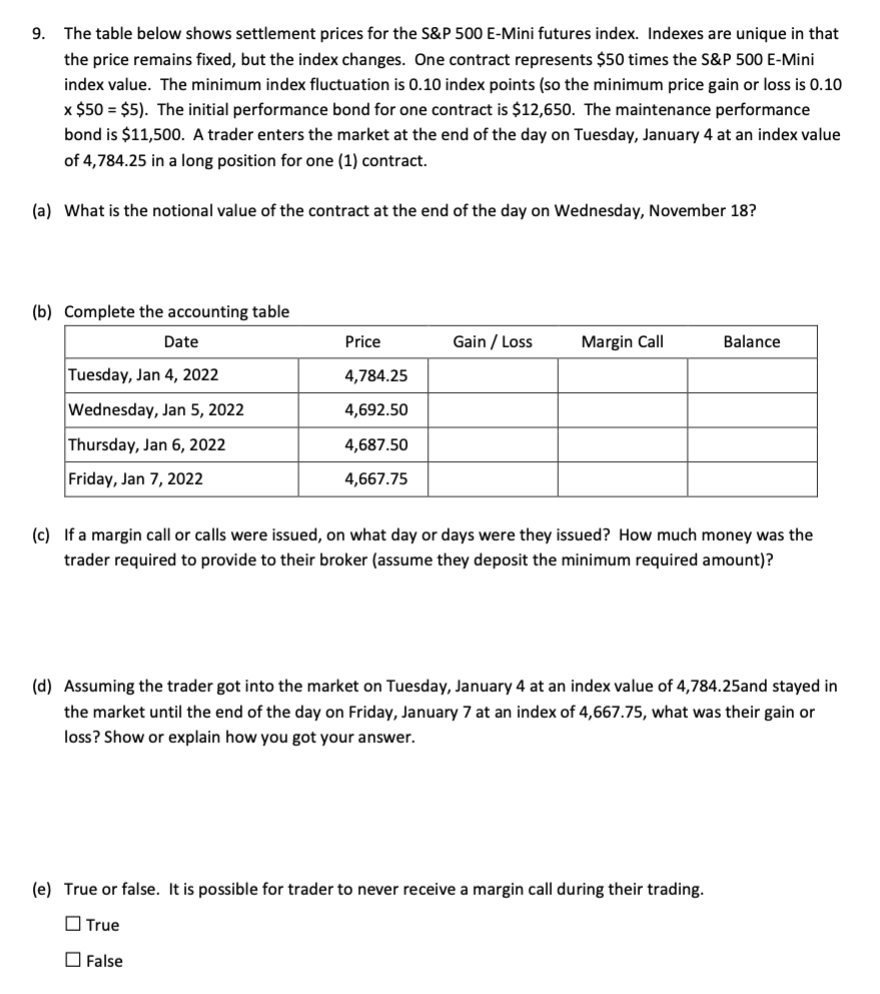

9. The table below shows settlement prices for the S\&P 500EMini futures index. Indexes are unique in that the price remains fixed, but the index changes. One contract represents $50 times the S\&P 500EMMini index value. The minimum index fluctuation is 0.10 index points (so the minimum price gain or loss is 0.10 x$50=$5 ). The initial performance bond for one contract is $12,650. The maintenance performance bond is $11,500. A trader enters the market at the end of the day on Tuesday, January 4 at an index value of 4,784.25 in a long position for one (1) contract. (a) What is the notional value of the contract at the end of the day on Wednesday, November 18 ? (b) Complete the accounting table (c) If a margin call or calls were issued, on what day or days were they issued? How much money was the trader required to provide to their broker (assume they deposit the minimum required amount)? (d) Assuming the trader got into the market on Tuesday, January 4 at an index value of 4,784.25and stayed in the market until the end of the day on Friday, January 7 at an index of 4,667.75, what was their gain or loss? Show or explain how you got your answer. (e) True or false. It is possible for trader to never receive a margin call during their trading. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts