Question: 9 Use the two period Binomial Model for a stock that is $50 today and can move up or down 10% each period. The strike

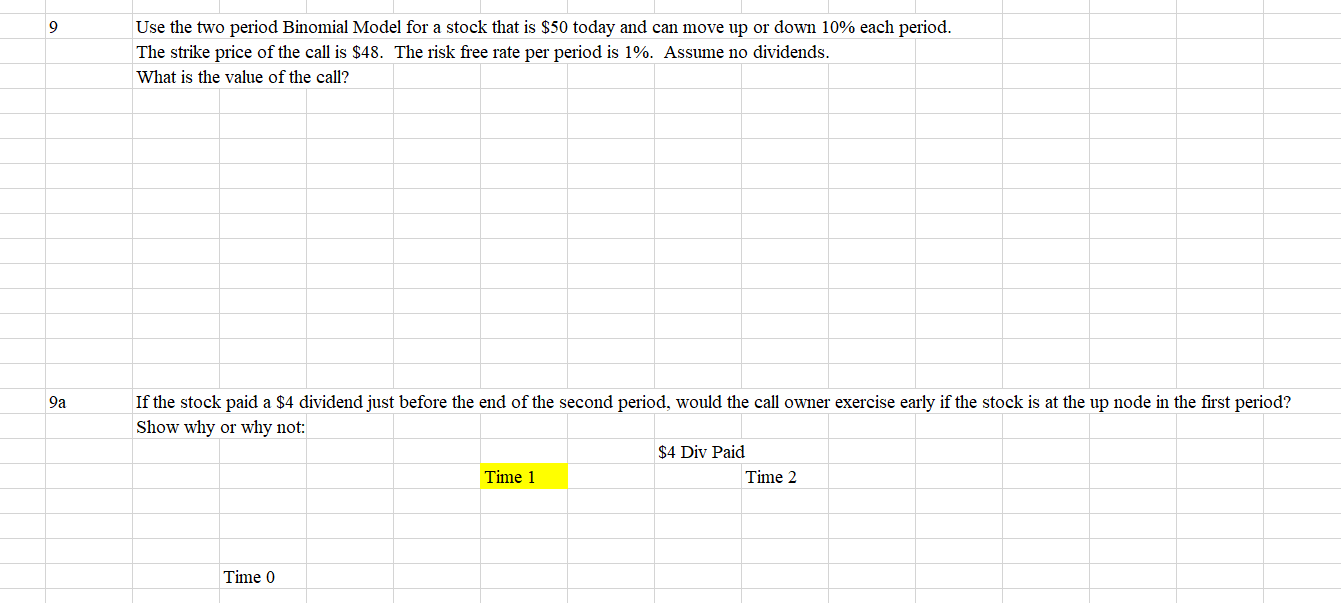

9 Use the two period Binomial Model for a stock that is $50 today and can move up or down 10% each period. The strike price of the call is $48. The risk free rate per period is 1%. Assume no dividends. What is the value of the call? 9a If the stock paid a $4 dividend just before the end of the second period, would the call owner exercise early if the stock is at the up node in the first period? Show why or why not: $4 Div Paid Time 1 Time 2 Time 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts