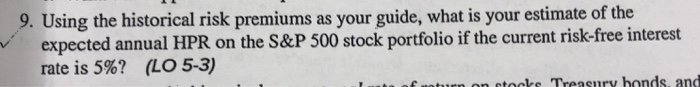

Question: 9. Using the historical risk premiums as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if

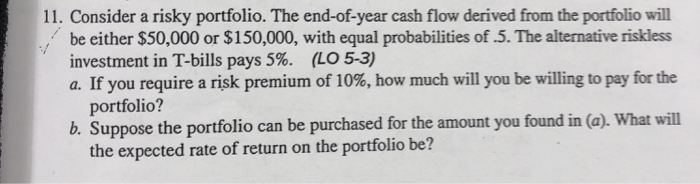

9. Using the historical risk premiums as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free interest rate is 5%? (LO 5-3) Td 11. Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $50,000 or $150,000, with equal probabilities of .5. The alternative riskless investment in T-bills pays 5%. (LO 5-3) a. If you require a risk premium of 10%, how much will you be willing to pay for the portfolio? b. Suppose the portfolio can be purchased for the amount you found in (a). What will the expected rate of return on the portfolio be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock