Question: 9) What is the MIRR for a project with the following annual cash flows: CF0=-$120; CF1=$60; CF2=$60? Assume WACC is 20%. 10) What is the

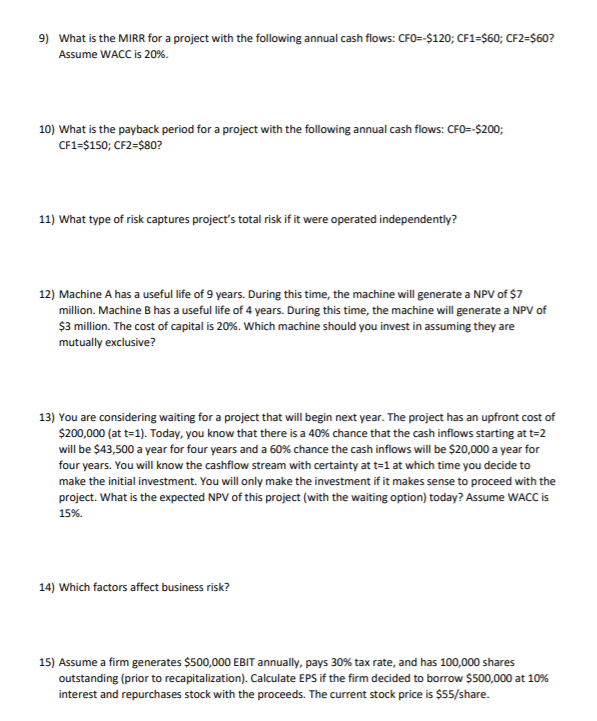

9) What is the MIRR for a project with the following annual cash flows: CF0=-$120; CF1=$60; CF2=$60? Assume WACC is 20%. 10) What is the payback period for a project with the following annual cash flows: CFO--$200; CF1=$150; CF2=$80? 11) What type of risk captures project's total risk if it were operated independently? 12) Machine A has a useful life of 9 years. During this time, the machine will generate a NPV of $7 million Machine B has a useful life of 4 years. During this time, the machine will generate a NPV of $3 million. The cost of capital is 20%. Which machine should you invest in assuming they are mutually exclusive? 13) You are considering waiting for a project that will begin next year. The project has an upfront cost of $200,000 (at t=1). Today, you know that there is a 40% chance that the cash inflows starting at t=2 will be $43,500 a year for four years and a 60% chance the cash inflows will be $20,000 a year for four years. You will know the cashflow stream with certainty at t=1 at which time you decide to make the initial investment. You will only make the investment if it makes sense to proceed with the project. What is the expected NPV of this project (with the waiting option) today? Assume WACC is 15% 14) Which factors affect business risk? 15) Assume a firm generates $500,000 EBIT annually, pays 30% tax rate, and has 100,000 shares outstanding (prior to recapitalization). Calculate EPS if the firm decided to borrow $500,000 at 10% interest and repurchases stock with the proceeds. The current stock price is $55/share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts