Question: 9. Which statement is correct? A. An IPO is carried out pursuant to regulations under the Securities Exchange Act of 1934. B. Common stock cannot

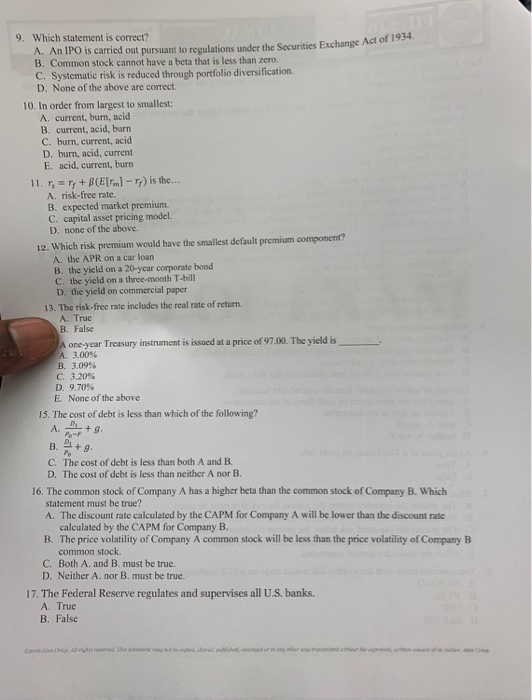

9. Which statement is correct? A. An IPO is carried out pursuant to regulations under the Securities Exchange Act of 1934. B. Common stock cannot have a beta that is less than zero. C. Systematic risk is reduced through portfolio diversification. D. None of the above are correct 10. In order from largest to smallest: A. current, burn, acid B. current, acid, barn C. burn, current, acid D. burn, acid, current E. acid, current, burn 1 1-S-T7 + (E(r,"I-r) is the A. risk-free rate. B. expected market premium. C. capital asset pricing model. D. none of the above. 12. Which risk premium would have the smallest default premium component? A. the APR on a car loan B. the yield on a 20-ycar corporate bond C. the yield on a three-month T-bil D. the yield on commercial paper 13. The risk-free rate includes the real rate of return. A. Truc B. False A one year Treasury instrument is issued at a price of 97.00. The yield is A, 3.00% 13. 309% C. 3.20% D. 9.70% E. None of the above 15. The cost of debt is less than which of the following? C. The cost of debt is less than both A and B. D. The cost of debt is less than neither A nor B. 16. The common stock of Company A has a higher beta than the common stock of Company B. Which statement must be true? A. The discount rate calculated by the CAPM for Company A will be lower than the discount rate calculated by the CAPM for Company B B. The price volatility of Company A common stock will be less than the price volatility of Company B common stock C. Both A. and B. must be true. D. Neither A. nor B. must be true. 17. The Federal Reserve regulates and supervises all U.S. banks. A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts