Question: 9. Williams Inc. has collected payroll data for the most recent weekly pay period: Assume CPP is 4.95% on the annual pensionable earnings of $50,100($55,900

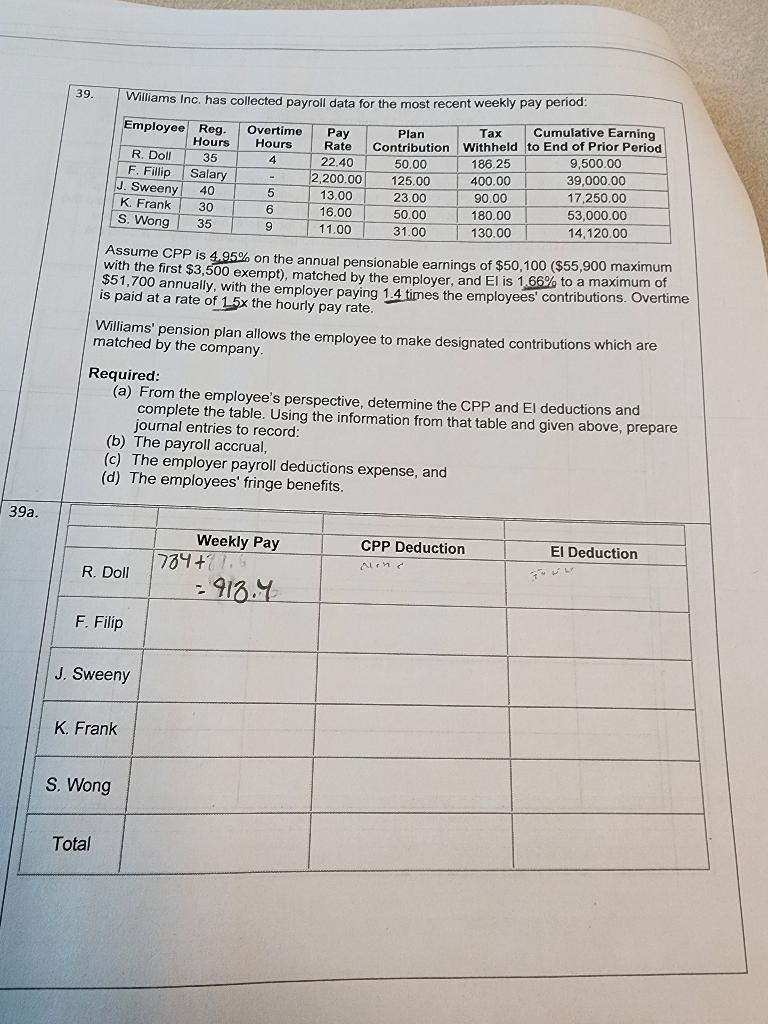

9. Williams Inc. has collected payroll data for the most recent weekly pay period: Assume CPP is 4.95% on the annual pensionable earnings of $50,100($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1,66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Overtime is paid at a rate of 15x the hourly pay rate. Williams' pension plan allows the employee to make designated contributions which are matched by the company. Required: (a) From the employee's perspective, determine the CPP and El deductions and complete the table. Using the information from that table and given above, prepare journal entries to record: (b) The payroll accrual, (c) The employer payroll deductions expense, and (d) The employees' fringe benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts