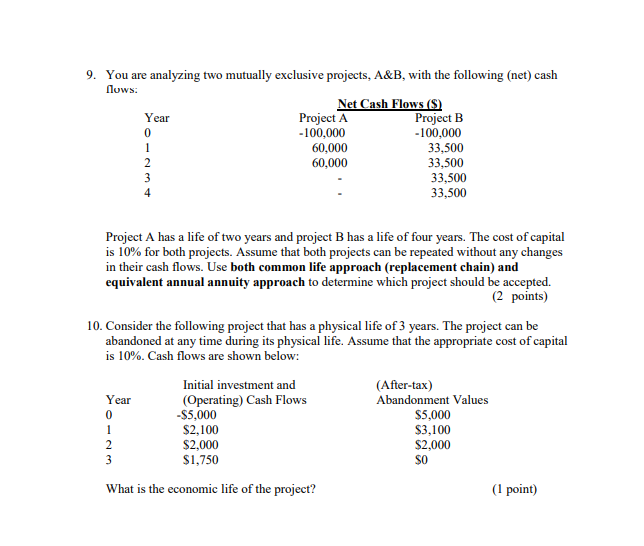

Question: 9. You are analyzing two mutually exclusive projects, A&B, with the following (net) cash lows: Net Cash Flows Year Project A -100,000 60,000 60,000 Project

9. You are analyzing two mutually exclusive projects, A&B, with the following (net) cash lows: Net Cash Flows Year Project A -100,000 60,000 60,000 Project B 100,000 33,500 33,500 33,500 33,500 4 Project A has a life of two years and project B has a life of four years. The cost of capital is 10% for both projects. Assume that both projects can be repeated without any changes in their cash flows. Use both common life approach (replacement chain) and equivalent annual annuity approach to determine which project should be accepted. (2 points) 10. Consider the following project that has a physical life of 3 years. The project can be abandoned at any time during its physical life. Assume that the appropriate cost of capital is 10%. Cash flows are shown below: Initial investment and (Operating) Cash Flows (After-tax) ear 0 -$5,000 $2,100 $2,000 $1,750 $5,000 $3,100 $2,000 SO What is the economic life of the project? (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts