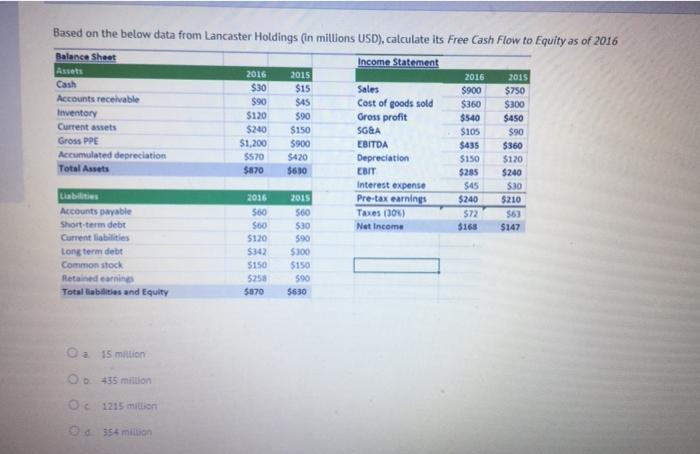

Question: $90 $570 Based on the below data from Lancaster Holdings (in millions USD), calculate its Free Cash Flow to Equity as of 2016 Balance Sheet

$90 $570 Based on the below data from Lancaster Holdings (in millions USD), calculate its Free Cash Flow to Equity as of 2016 Balance Sheet Income Statement Assets 2016 2015 2016 2015 Cash $30 $15 Sales $900 $750 Accounts receivable $90 $45 Cost of goods sold $360 $300 Inventory $120 Gross profit $540 $450 Current assets $240 $150 SG&A $105 $90 Gross PPE $1,200 5900 EBITDA $435 $360 Accumulated depreciation $420 Depreciation $150 $120 Total Assets $870 3630 EBIT $285 $240 Interest expense $45 S30 Liabilities 2016 2015 Pre-tax earnings $240 $210 Accounts payable 560 560 Taxes (30%) 572 $63 Short-term debit Soo $30 Net Income $168 $147 Current liabilities 5120 Long term diebt $342 $300 Common stock $150 5150 Retained earning 5258 Total liabilities and Equity 5070 56.30 590 590 a 15 million 435 million Oc 1215 milion Od 354 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts