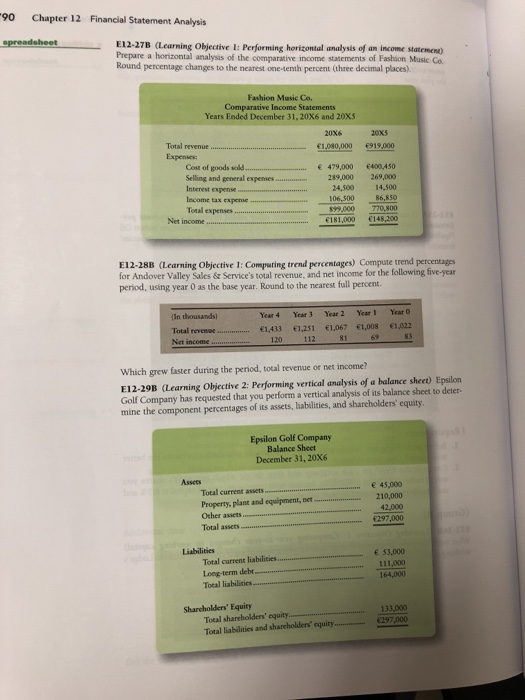

Question: 90 Chapter 12 Financial Statement Analysis spreadsheetE12-27B (Learning Objective 1: Performing horizontal analysis of am income statemen) Prepare a horizontal analysis of the comparative income

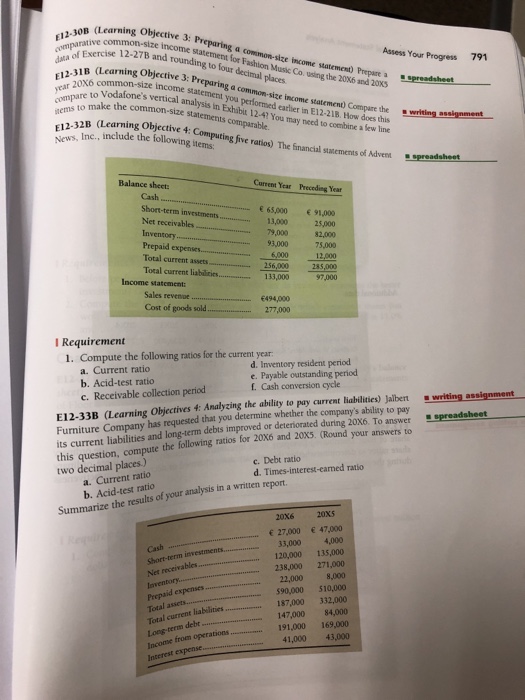

90 Chapter 12 Financial Statement Analysis spreadsheetE12-27B (Learning Objective 1: Performing horizontal analysis of am income statemen) Prepare a horizontal analysis of the comparative income statements of Fashion Music Co Round percentage changes to the nearest one-temh percent (three decimal places). Fashion Music Co. Comparative Income Statements Years Ended December 31, 20X6 and 20xS 20x6 20x5 Total revenue 1.080,000 919.000 Expenses: Cost of goods sold Selling and general Interest expense Income tax expense Toral expenses 479,000 400450 289,000 269,000 24,500 14,500 106.50086,850 9,000770,800 181,000 148,200 Net income E12-28B (Learning Objective I:Comparing trend percentages) Compute trend percentages for Andover Valley Sales&Service's total revenue, and net income for the following five-year period, using year 0 as the base year. Round to the nearest fall percoent. Year 4 Year 3 Year 2 Year 1 Year 0 In thousands) Total revenue Net income 1,433 1.251 1,067 1,008 1,022 s3 120 112 81 Which grew faster during the period, total revenue or net income? E12-29B (Learning Objective 2: Performing vertical analysis of a balance sheet) Epsilon Golf Company has requested that you perform a vertical analysis of its balance sheet to deter- mine the component percentages of its assets, habilities, and shareholders' equity Epsilon Golf Company Balance Sheet December 31, 20x6 Assets 45,000 Total current assets Property, plant and equipment, net Other assets Total assets 210,000 42,000 297,000 53,000 111,000 164,000 Liabilities Total current liabilities Long-term debt Toral liabilities Shareholders' Equity Tocal shareholders' equity Total liabilities and shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts