Question: $90 million. State how your tabulation in requirement 2 would change. UIl . Suppose Company A had paid $100 million instead of 11-48 R Allocating

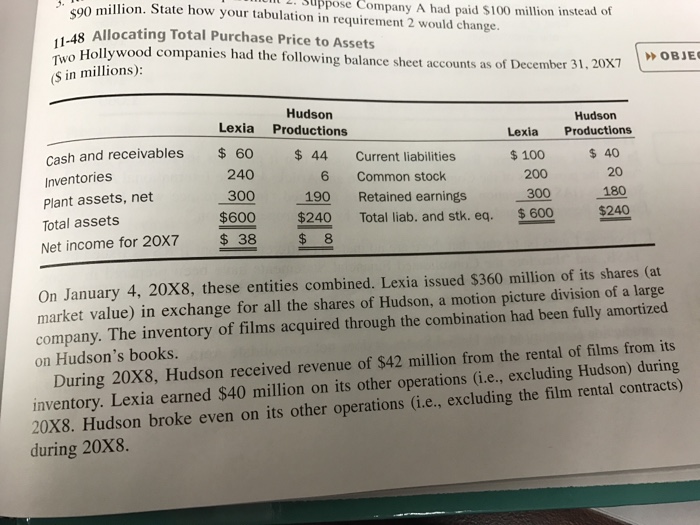

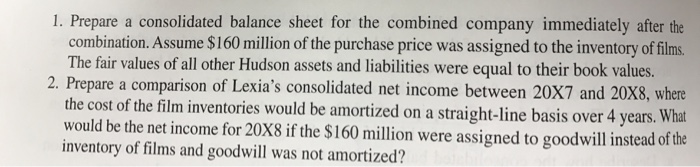

$90 million. State how your tabulation in requirement 2 would change. UIl . Suppose Company A had paid $100 million instead of 11-48 R Allocating Total Purchase Price to Assets wo Hollywood companies had the following balance sheet accounts as of December 31,20x7 Two S in millions): cember 31, 20X7 | >> OBJE Hudson Lexia Productions Hudson Lexia Productions Cash and receivables 60 240 300 $600 for 20X7 38 $60 $44 Current liabilities $100 $ 40 Inventories Plant assets, net Total assets Net income for 20X7 6 Common stock 200 20 190 Retained earnings 300 160 180 $240 8 Total liab. and stk. eq. $600 s222 On January 4, 20X8, these entities combined. Lexia issued $360 million of its shares (at market value) in exchange for all the shares of Hudson, a motion picture division of a large company. The inventory of films acquired through the combination had been fully amortized on Hudson's books. During 20X8, Hudson received revenue of $42 million from the rental of films from its inventory. Lexia earned $40 million on its other operations (i.e., excluding Hudson) during 20X8. Hudson broke even on its other o 20x8. Hudson broke even on its other operations (i.e., excluding the film rental contracts) during 20X8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts