Question: 9:02 - LTE X FIN 470 - Assignment #16.pdf ... FIN 470 - Assignment 16 1. A manager decides not to lend to any firm

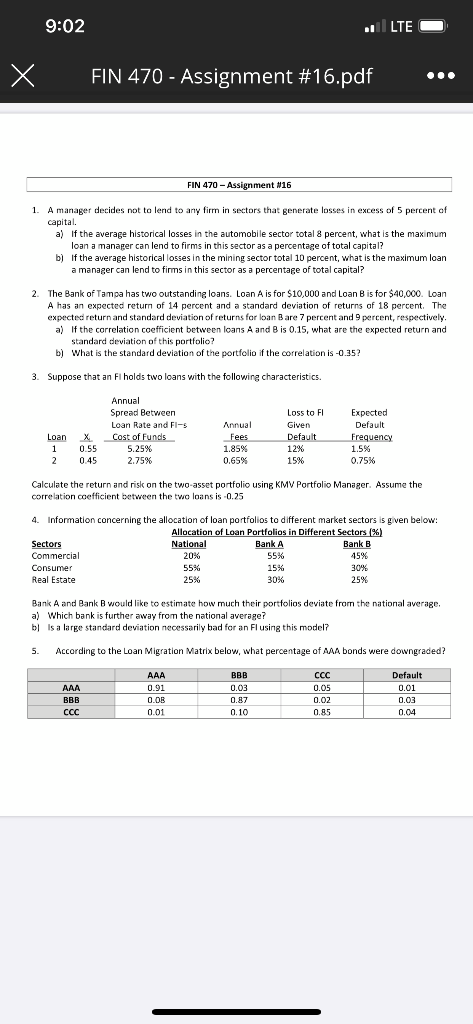

9:02 - LTE X FIN 470 - Assignment #16.pdf ... FIN 470 - Assignment 16 1. A manager decides not to lend to any firm in sectors that generate losses in excess of 5 percent of capital a) If the average historical losses in the automobile sector total 8 percent, what is the maximum loan a manager can lend to firms in this sector as a percentage of total capital? b) If the average historical losses in the mining sector total 10 percent, what is the maximum loan a manager can lend to firms in this sector as a percentage of total capital? The Bank of Tampa has two outstanding loans. Loan A is for $10,000 and Loan B is for $40,000 Loan A has an expected return of 14 percent and a standard deviation of returns of 18 percent. The expected return and standard deviation of returns for loan Bare 7 percent and 9 percent, respectively a) If the correlation coefficient between loans A and B is 0.15, what are the expected return and standard deviation of this portfolio? b) What is the standard deviation of the portfolio if the correlation is -0.35? 3. Suppose that an Fl holds two loans with the following characteristics. Annual Spread Between Loan Rate and Fl-s Cost of Funds 5.25% 2.75% Loan 1 2 X 0.55 0.45 Annual Fees 1.85% 0.65% Loss to F1 Given Default 12% 15% Expected Default Frequency 1.5% 0.75% Calculate the return and risk on the two-asset portfolio using KMV Portfolio Manager. Assume the correlation coefficient between the two loans is -0.25 4. Information concerning the allocation of loan portfolios to different market sectors is given below! Allocation of Loan Portfolios in Different sectors (%) Sectors National Bank A Bank B Commercial Consumer 55% 15% 30% Real Estate 25% 30% 25% 20% 55% 45% Bank A and Bank B would like to estimate how much their portfolios deviate from the national average. a) which bank is further away from the national average? bl is a large standard deviation necessarily bad for an Fl using this model? 5. According to the Loan Migration Matrix below, what percentage of AAA bonds were downgraded? AAA BBB CCC AAA 0.91 0.08 0.01 BBB 0.03 0.87 0. 10 0.05 0.02 .85 Default 0.01 0.03 0.04 0 9:02 - LTE X FIN 470 - Assignment #16.pdf ... FIN 470 - Assignment 16 1. A manager decides not to lend to any firm in sectors that generate losses in excess of 5 percent of capital a) If the average historical losses in the automobile sector total 8 percent, what is the maximum loan a manager can lend to firms in this sector as a percentage of total capital? b) If the average historical losses in the mining sector total 10 percent, what is the maximum loan a manager can lend to firms in this sector as a percentage of total capital? The Bank of Tampa has two outstanding loans. Loan A is for $10,000 and Loan B is for $40,000 Loan A has an expected return of 14 percent and a standard deviation of returns of 18 percent. The expected return and standard deviation of returns for loan Bare 7 percent and 9 percent, respectively a) If the correlation coefficient between loans A and B is 0.15, what are the expected return and standard deviation of this portfolio? b) What is the standard deviation of the portfolio if the correlation is -0.35? 3. Suppose that an Fl holds two loans with the following characteristics. Annual Spread Between Loan Rate and Fl-s Cost of Funds 5.25% 2.75% Loan 1 2 X 0.55 0.45 Annual Fees 1.85% 0.65% Loss to F1 Given Default 12% 15% Expected Default Frequency 1.5% 0.75% Calculate the return and risk on the two-asset portfolio using KMV Portfolio Manager. Assume the correlation coefficient between the two loans is -0.25 4. Information concerning the allocation of loan portfolios to different market sectors is given below! Allocation of Loan Portfolios in Different sectors (%) Sectors National Bank A Bank B Commercial Consumer 55% 15% 30% Real Estate 25% 30% 25% 20% 55% 45% Bank A and Bank B would like to estimate how much their portfolios deviate from the national average. a) which bank is further away from the national average? bl is a large standard deviation necessarily bad for an Fl using this model? 5. According to the Loan Migration Matrix below, what percentage of AAA bonds were downgraded? AAA BBB CCC AAA 0.91 0.08 0.01 BBB 0.03 0.87 0. 10 0.05 0.02 .85 Default 0.01 0.03 0.04 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts