Question: 9-1 Practice Exercises i 1 16 Required information Saved Part 2 of 3 [The following information applies to the questions displayed below.] David's basis

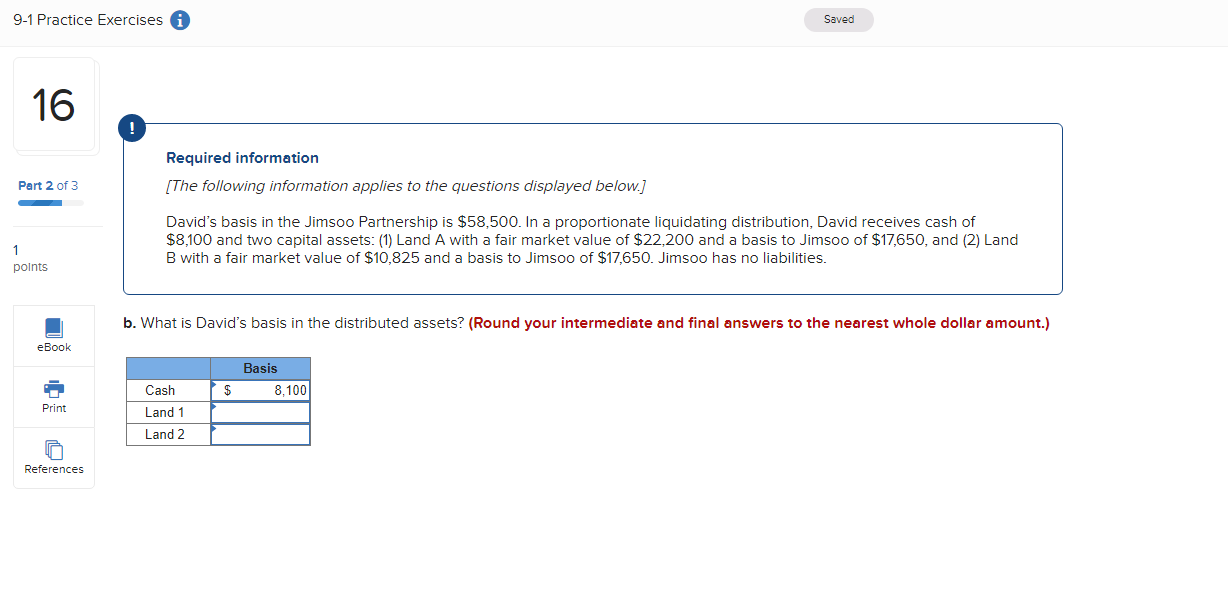

9-1 Practice Exercises i 1 16 Required information Saved Part 2 of 3 [The following information applies to the questions displayed below.] David's basis in the Jimsoo Partnership is $58,500. In a proportionate liquidating distribution, David receives cash of $8,100 and two capital assets: (1) Land A with a fair market value of $22,200 and a basis to Jimsoo of $17,650, and (2) Land B with a fair market value of $10,825 and a basis to Jimsoo of $17,650. Jimsoo has no liabilities. points eBook b. What is David's basis in the distributed assets? (Round your intermediate and final answers to the nearest whole dollar amount.) Basis Cash $ 8,100 Print Land 1 Land 2 References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts