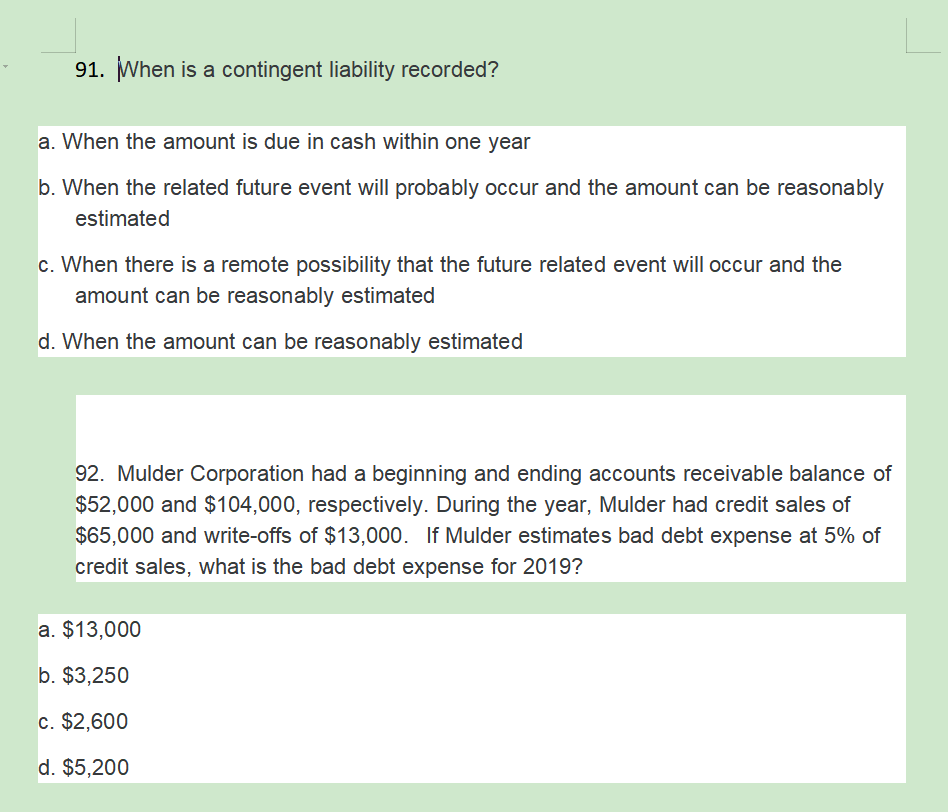

Question: 91. When is a contingent liability recorded? a. When the amount is due in cash within one year b. When the related future event will

91. When is a contingent liability recorded? a. When the amount is due in cash within one year b. When the related future event will probably occur and the amount can be reasonably estimated c. When there is a remote possibility that the future related event will occur and the amount can be reasonably estimated d. When the amount can be reasonably estimated 92. Mulder Corporation had a beginning and ending accounts receivable balance of $52,000 and $104,000, respectively. During the year, Mulder had credit sales of $65,000 and write-offs of $13,000. If Mulder estimates bad debt expense at 5% of credit sales, what is the bad debt expense for 2019? a. $13,000 b. $3,250 c. $2,600 d. $5,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts