Question: 9-10 9-10. EI Norte Industries will issue $100 par, 12 percent preferred stock. The market price for the stock is expected to be $89 per

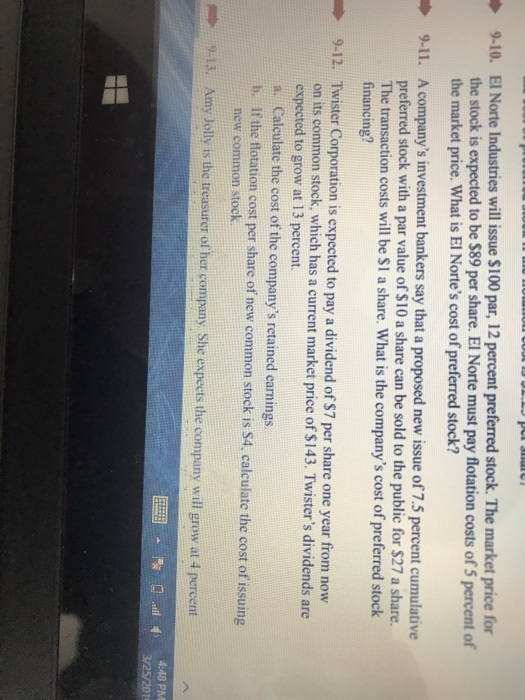

9-10. EI Norte Industries will issue $100 par, 12 percent preferred stock. The market price for the stock is expected to be $89 per share. El Norte must pay flotation costs of 5 percent of the market price. What is El Norte's cost of preferred stock? 9-11. A company's investment bankers say that a proposed new issue of 7.5 percent cumulative preferred stock with a par value of $10 a share can be sold to the public for $27 a share. The transaction costs will be SI a share. What is the company's cost of preferred stock financing? 9-12. Twister Corporation is expected to pay a dividend of $7 per share one year from now on its common stock, which has a current market price of $143. Twister's dividends are expected to grow at 13 percent. a. Caleulate the cost of the company's retained carnings. b. If the flotation cost per share of new common stock is $4, calculate the cost of issuing new common stock 9-13. Amy Jolly is the treasurer of her company She expects the company will grow at 4 percent 4:48 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts