Question: 9.18 Undervalued assets, full and partial goodwill method, intragroup transactions * * L03, 4, 6 On 1 July 2018, Robert Ltd acquired 75% of the

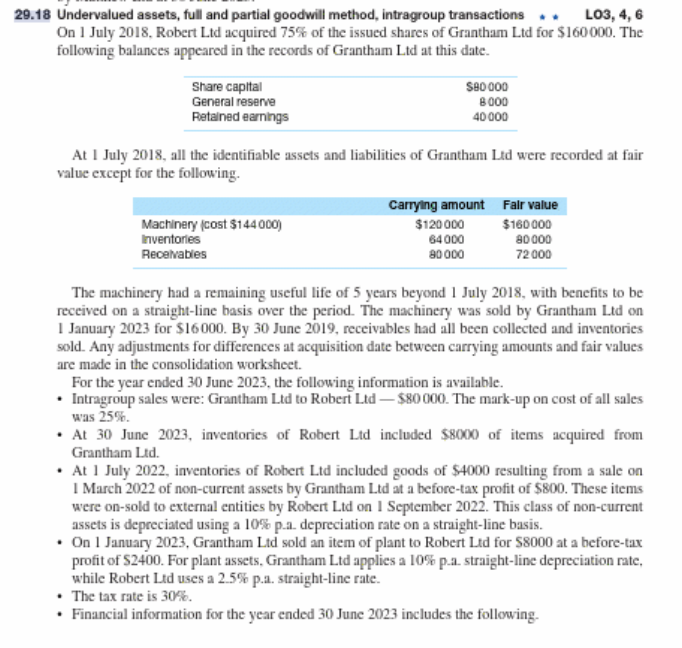

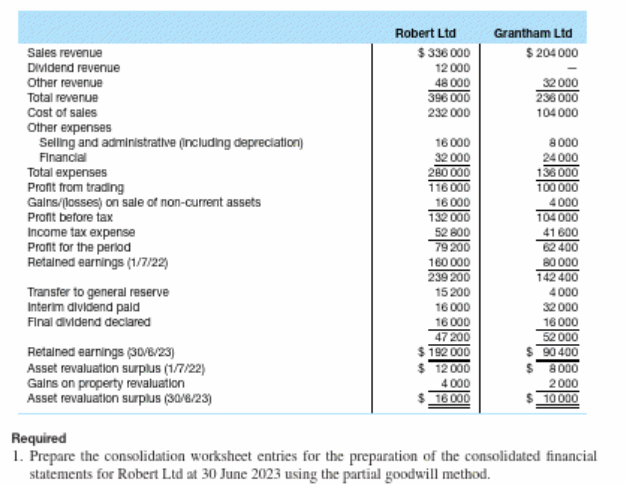

9.18 Undervalued assets, full and partial goodwill method, intragroup transactions * * L03, 4, 6 On 1 July 2018, Robert Ltd acquired 75% of the issued shares of Grantham Ltd for $160000. The following balances appeared in the records of Grantham Ltd at this date. At I July 2018, all the identifiable assets and liabilities of Grantham Ltd were recorded at fair value except for the following. The machinery had a remaining useful life of 5 years beyond 1 July 2018, with benefits to be received on a straight-line basis over the period. The machinery was sold by Grantham Ltd on 1 January 2023 for $16000. By 30 June 2019, receivables had all been collected and inventories sold. Any adjustments for differences at acquisition date between carrying amounts and fair values are made in the consolidation worksheet. For the year ended 30 June 2023, the following information is available. - Intragroup sales were: Grantham Ltd to Robert Ltd - $80000. The mark-up on cost of all sales was 25%. - At 30 June 2023, inventories of Robert Lid included $8000 of items acquired from Grantham Lid. - At 1 July 2022, inventories of Robert Ltd included goods of $4000 resulting from a sale on 1 March 2022 of non-current assets by Grantham Ltd at a before-tax profit of $800. These items were on-sold to external entities by Robert Ltd on I September 2022. This class of non-current assets is depreciated using a 10% p.a. depreciation rate on a straight-line basis. - On 1 January 2023, Grantham Ltd sold an item of plant to Robert Ltd for $8000 at a before-tax profit of $2400. For plant assets, Grantham Ltd applies a 10% p-a. straight-line depreciation rate, while Robert Ltd uses a 2.5% p.a. straight-line rate. - The tax rate is 30%. - Financial information for the year ended 30 June 2023 includes the following. Required 1. Prepare the consolidation worksheet entries for the preparation of the consolidated financial statements for Robert Ltd at 30 June 2023 using the partial goodwill method. 9.18 Undervalued assets, full and partial goodwill method, intragroup transactions * * L03, 4, 6 On 1 July 2018, Robert Ltd acquired 75% of the issued shares of Grantham Ltd for $160000. The following balances appeared in the records of Grantham Ltd at this date. At I July 2018, all the identifiable assets and liabilities of Grantham Ltd were recorded at fair value except for the following. The machinery had a remaining useful life of 5 years beyond 1 July 2018, with benefits to be received on a straight-line basis over the period. The machinery was sold by Grantham Ltd on 1 January 2023 for $16000. By 30 June 2019, receivables had all been collected and inventories sold. Any adjustments for differences at acquisition date between carrying amounts and fair values are made in the consolidation worksheet. For the year ended 30 June 2023, the following information is available. - Intragroup sales were: Grantham Ltd to Robert Ltd - $80000. The mark-up on cost of all sales was 25%. - At 30 June 2023, inventories of Robert Lid included $8000 of items acquired from Grantham Lid. - At 1 July 2022, inventories of Robert Ltd included goods of $4000 resulting from a sale on 1 March 2022 of non-current assets by Grantham Ltd at a before-tax profit of $800. These items were on-sold to external entities by Robert Ltd on I September 2022. This class of non-current assets is depreciated using a 10% p.a. depreciation rate on a straight-line basis. - On 1 January 2023, Grantham Ltd sold an item of plant to Robert Ltd for $8000 at a before-tax profit of $2400. For plant assets, Grantham Ltd applies a 10% p-a. straight-line depreciation rate, while Robert Ltd uses a 2.5% p.a. straight-line rate. - The tax rate is 30%. - Financial information for the year ended 30 June 2023 includes the following. Required 1. Prepare the consolidation worksheet entries for the preparation of the consolidated financial statements for Robert Ltd at 30 June 2023 using the partial goodwill method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts