Question: 9.2- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. 4. 5. Yang Company sold merchandise for $4,000. The event is subject

9.2-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

1.

2.

3.

4.

5.

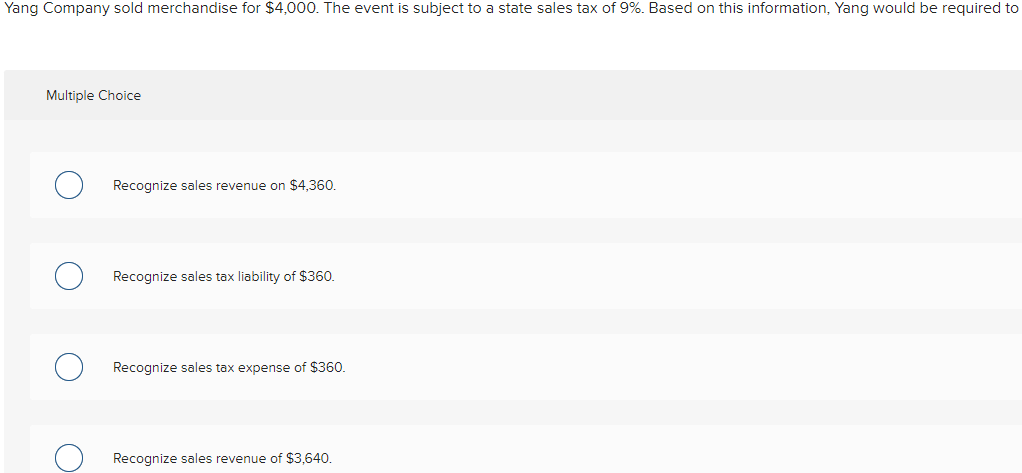

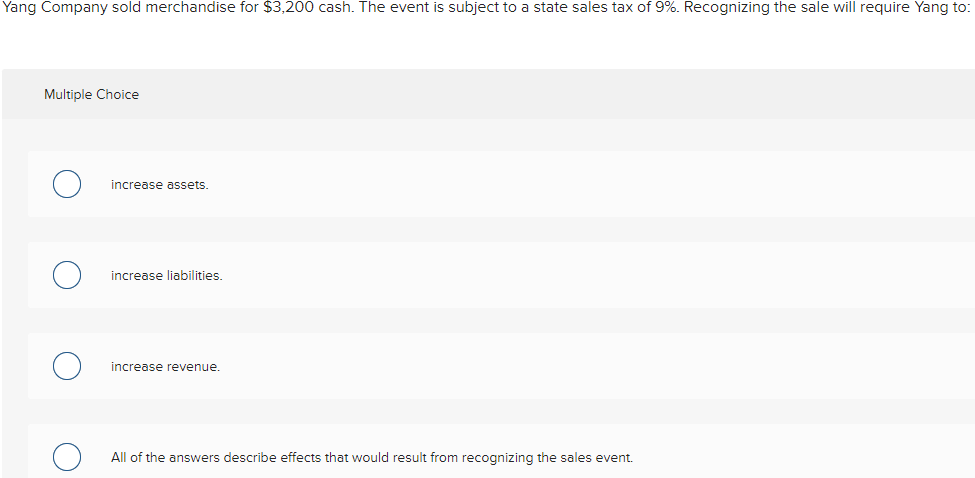

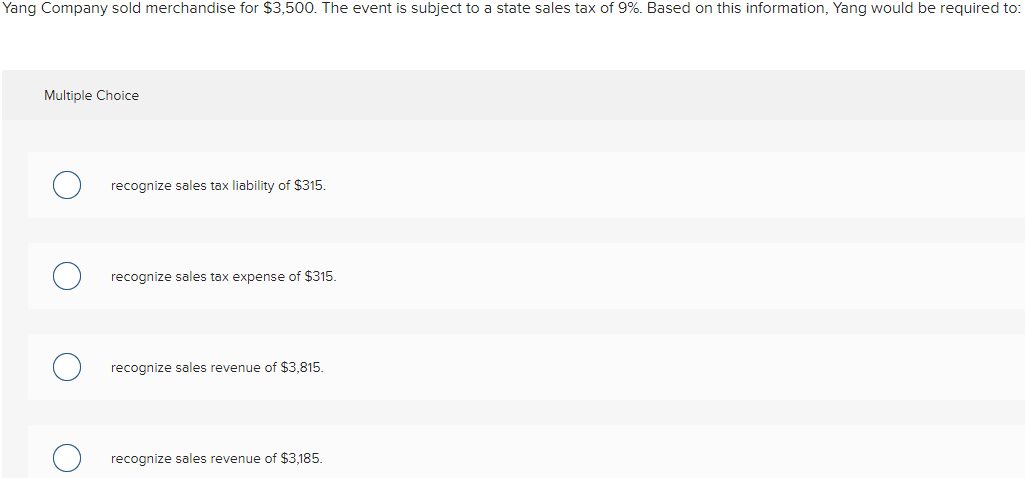

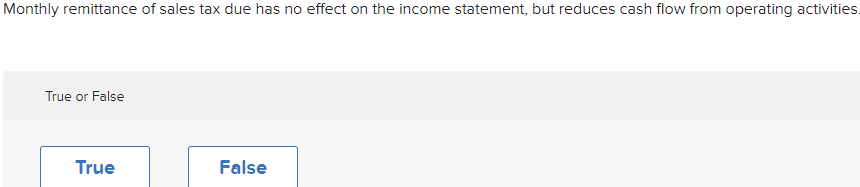

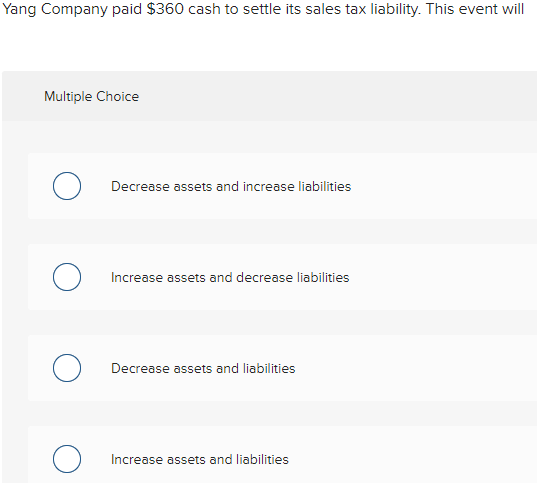

Yang Company sold merchandise for $4,000. The event is subject to a state sales tax of 9%. Based on this information, Yang would be required to Multiple Choice Recognize sales revenue on $4,360. Recognize sales tax liability of $360. Recognize sales tax expense of $360. Recognize sales revenue of $3,640. Multiple Choice increase assets. increase liabilities. increase revenue. All of the answers describe effects that would result from recognizing the sales event. lang Company sold merchandise for $3,500. The event is subject to a state sales tax of 9%. Based on this information, Yang would be required to: Multiple Choice recognize sales tax liability of $315. recognize sales tax expense of \$315. recognize sales revenue of $3,815. recognize sales revenue of $3,185. Monthly remittance of sales tax due has no effect on the income statement, but reduces cash flow from operating activities True or False Yang Company paid $360 cash to settle its sales tax liability. This event will Multiple Choice Decrease assets and increase liabilities Increase assets and decrease liabilities Decrease assets and liabilities Increase assets and liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts