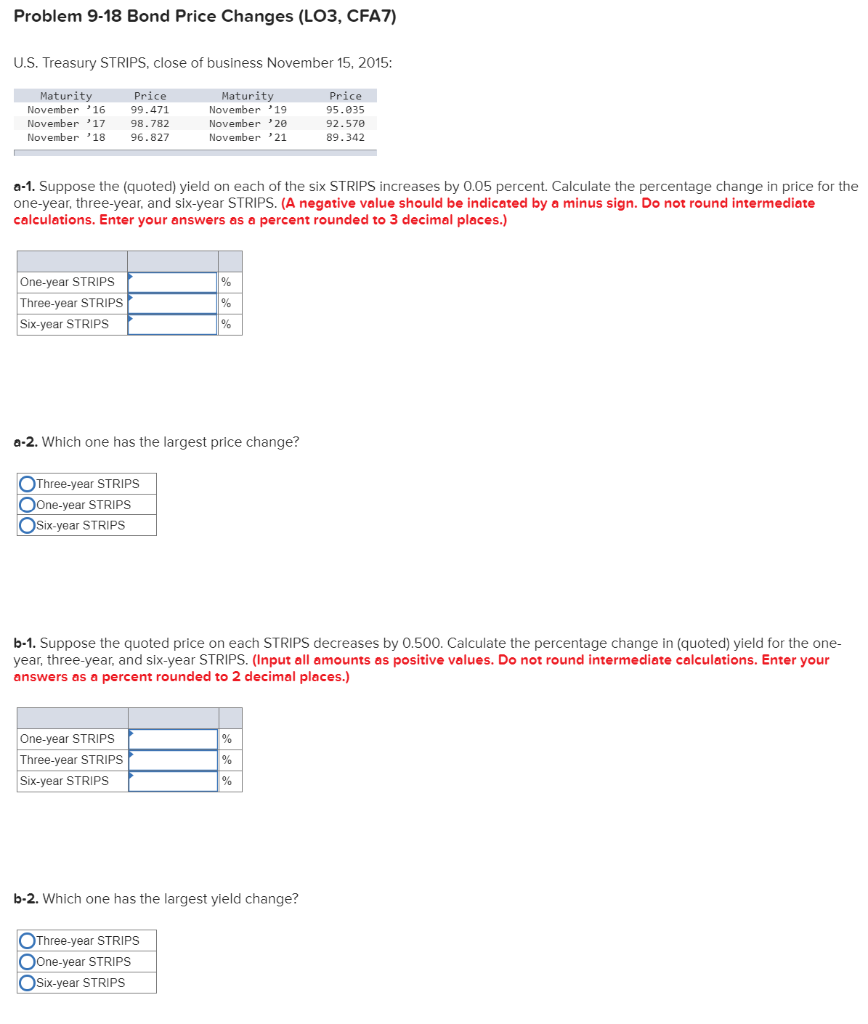

Question: 9-2 Problem 9-18 Bond Price Changes (LO3, CFA7) U.S. Treasury STRIPS, close of business November 15, 2015: Nove Maturity November '16 November '17 November '18

9-2

Problem 9-18 Bond Price Changes (LO3, CFA7) U.S. Treasury STRIPS, close of business November 15, 2015: Nove Maturity November '16 November '17 November '18 Price 99.471 98.782 96.827 Maturity November '19 November 20 November 21 Price 95.035 92.570 89.342 a-1. Suppose the (quoted) yield on each of the six STRIPS increases by 0.05 percent. Calculate the percentage change in price for the one-year, three-year, and six-year STRIPS. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places.) One-year STRIPS Three-year STRIPS Six-year STRIPS a-2. Which one has the largest price change? Three-year STRIPS One-year STRIPS Osix-year STRIPS b-1. Suppose the quoted price on each STRIPS decreases by 0.500. Calculate the percentage change in (quoted) yield for the one- year, three-year, and six-year STRIPS. (Input all amounts as positive values. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) One-year STRIPS Three-year STRIPS Six-year STRIPS b-2. Which one has the largest yield change? Three-year STRIPS O one-year STRIPS Six-year STRIPS Problem 9-18 Bond Price Changes (LO3, CFA7) U.S. Treasury STRIPS, close of business November 15, 2015: Nove Maturity November '16 November '17 November '18 Price 99.471 98.782 96.827 Maturity November '19 November 20 November 21 Price 95.035 92.570 89.342 a-1. Suppose the (quoted) yield on each of the six STRIPS increases by 0.05 percent. Calculate the percentage change in price for the one-year, three-year, and six-year STRIPS. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places.) One-year STRIPS Three-year STRIPS Six-year STRIPS a-2. Which one has the largest price change? Three-year STRIPS One-year STRIPS Osix-year STRIPS b-1. Suppose the quoted price on each STRIPS decreases by 0.500. Calculate the percentage change in (quoted) yield for the one- year, three-year, and six-year STRIPS. (Input all amounts as positive values. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) One-year STRIPS Three-year STRIPS Six-year STRIPS b-2. Which one has the largest yield change? Three-year STRIPS O one-year STRIPS Six-year STRIPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts