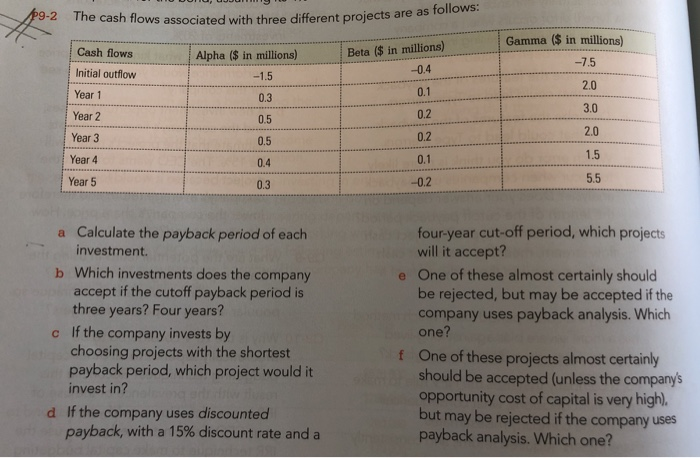

Question: 9-2 The cash flows associated with three different projects are as follows: Gamma (S in millions) Cash flows Initial outflow Year 1 Year 2 Year

9-2 The cash flows associated with three different projects are as follows: Gamma (S in millions) Cash flows Initial outflow Year 1 Year 2 Year 3 Year 4 Beta ($ in millions) Alpha ($ in millions) -0.4 2.0 3.0 2.0 1.5 5.5 0.3 0.5 0.5 0.4 0.3 0.2 0.2 0.1 -0.2 Year 5 four-year cut-off period, which projects Calculate the payback period of each a investment. will it accept? One of these almost certainly should be rejected, but may be accepted if the company uses payback analysis. Which one! b Which investments does the company e accept if the cutoff payback period is three years? Four years? If the company invests by choosing projects with the shortest payback period, which project would it invest in? c One of these projects almost certainly f should be accepted (unless the company's opportunity cost of capital is very high). If the company uses discounted payback, with a 15% discount rate and a d but may be rejected if the company uses payback analysis. Which one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts