Question: 9.22% is not the correct answer. Estimating the Market's Expected Growth Rate in Dividends Mattel Inc. was trading at a price of $9.99 per common

9.22% is not the correct answer.

9.22% is not the correct answer.

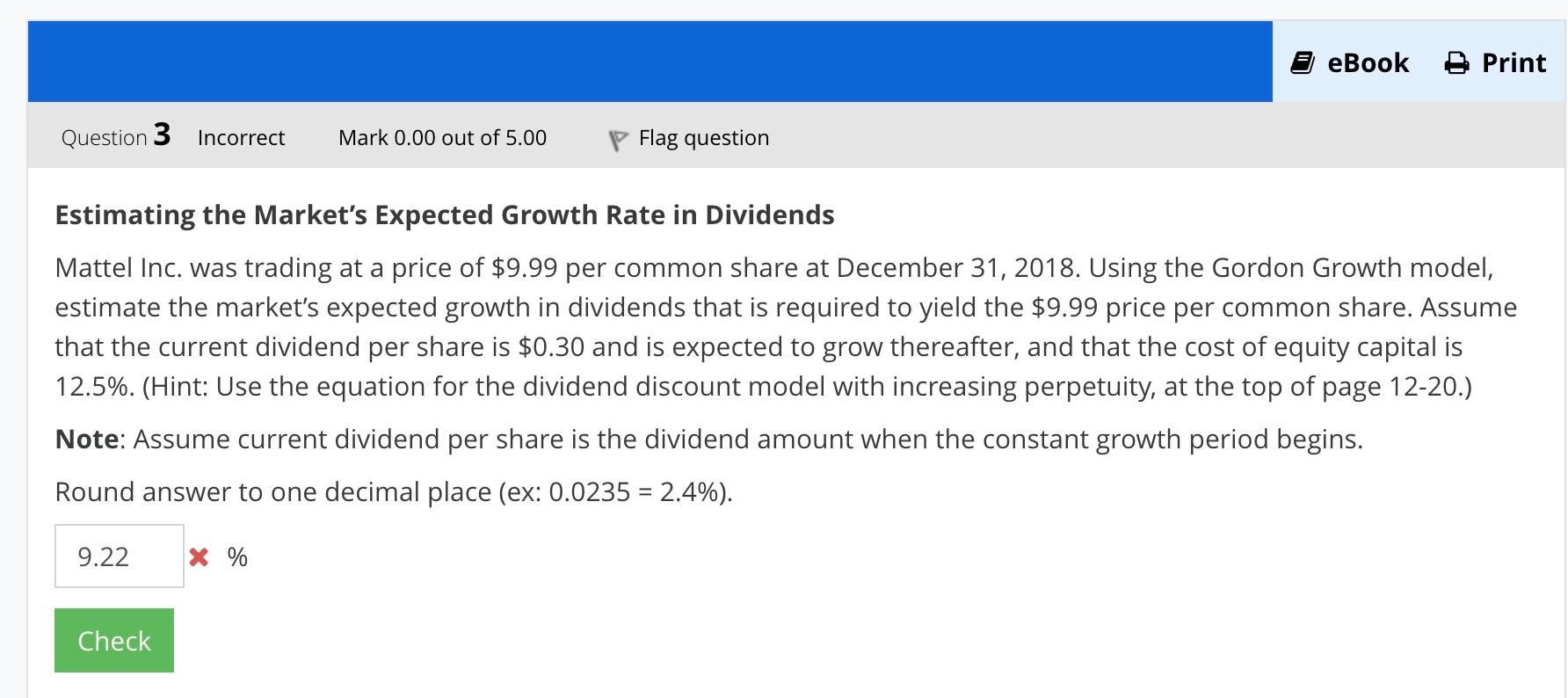

Estimating the Market's Expected Growth Rate in Dividends Mattel Inc. was trading at a price of $9.99 per common share at December 31, 2018. Using the Gordon Growth model, estimate the market's expected growth in dividends that is required to yield the $9.99 price per common share. Assume that the current dividend per share is $0.30 and is expected to grow thereafter, and that cost of equity capital is 12.5\%. (Hint: Use the equation for the dividend discount model with increasing perpetuity, at the top of page 12-20.) Note: Assume current dividend per share is the dividend amount when the constant growth period begins. Round answer to one decimal place (ex: 0.0235=2.4% ). % Estimating the Market's Expected Growth Rate in Dividends Mattel Inc. was trading at a price of $9.99 per common share at December 31, 2018. Using the Gordon Growth model, estimate the market's expected growth in dividends that is required to yield the $9.99 price per common share. Assume that the current dividend per share is $0.30 and is expected to grow thereafter, and that cost of equity capital is 12.5\%. (Hint: Use the equation for the dividend discount model with increasing perpetuity, at the top of page 12-20.) Note: Assume current dividend per share is the dividend amount when the constant growth period begins. Round answer to one decimal place (ex: 0.0235=2.4% ). %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts