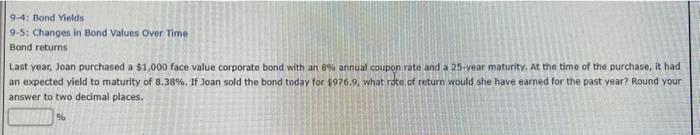

Question: 9-4: Bond Yields 9-5: Changes in Bond Values Over Time Bond returns Last year, Joan purchased a $1,000 face value corporate bond with an 8%3

9-4: Bond Yields 9-5: Changes in Bond Values Over Time Bond returns Last year, Joan purchased a $1,000 face value corporate bond with an 8%3 annual coupon rate and a 25 -year maturity. At the time of the purchase, it had an expected yield to maturity of 8.38%. If Joan sold the bond today for $976.9, what rate of return would she have earned for the past year? Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts