Question: 94) The Basle III capital requirements differ from previous Basel II capital standards in all it except one of the following ways? A) More stringent

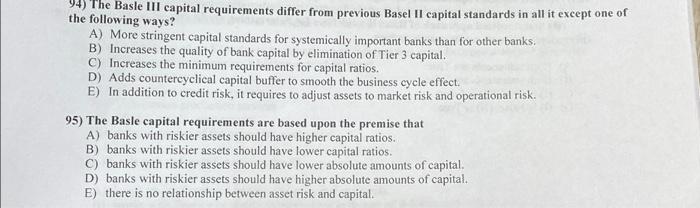

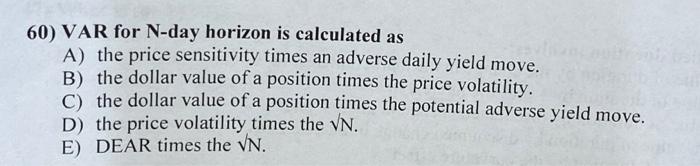

94) The Basle III capital requirements differ from previous Basel II capital standards in all it except one of the following ways? A) More stringent capital standards for systemically important banks than for other banks. B) Increases the quality of bank capital by elimination of Tier 3 capital. C) Increases the minimum requirements for capital ratios. D) Adds countercyclical capital buffer to smooth the business cycle effect. E) In addition to credit risk, it requires to adjust assets to market risk and operational risk. 95) The Basle capital requirements are based upon the premise that A) banks with riskier assets should have higher capital ratios. B) banks with riskier assets should have lower capital ratios. C) banks with riskier assets should have lower absolute amounts of capital. D) banks with riskier assets should have higher absolute amounts of capital. E) there is no relationship between asset risk and capital. 60) VAR for N-day horizon is calculated as A) the price sensitivity times an adverse daily yield move. B) the dollar value of a position times the price volatility. C) the dollar value of a position times the potential adverse yield move. D) the price volatility times the N. E) DEAR times the N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts