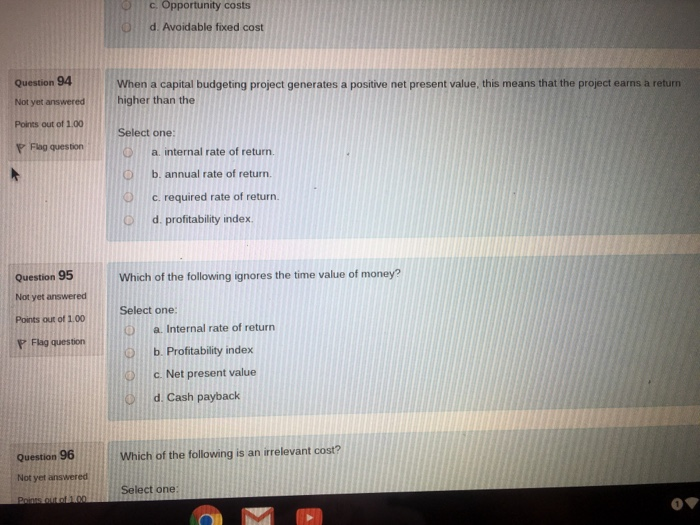

Question: 94,95 c. Opportunity costs d. Avoidable fixed cost Question 94 Not yet answeredhigher than the Points out of 1.00 When a capital budgeting project generates

c. Opportunity costs d. Avoidable fixed cost Question 94 Not yet answeredhigher than the Points out of 1.00 When a capital budgeting project generates a positive net present value, this means that the project earns a return Select one Oa. internal rate of return. O b. annual rate of return. Oc. required rate of return. Oll d. profitability index Flag questonOa. Question 95 Which of the following ignores the time value of money? Not yet answered Pores or of 1.00Select one P Flag question Flag questona. Internal rate of return b. Profitability index C. Net present value d. Cash payback Question 96 Not yet answered Which of the following is an irrelevant cost? Select one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts