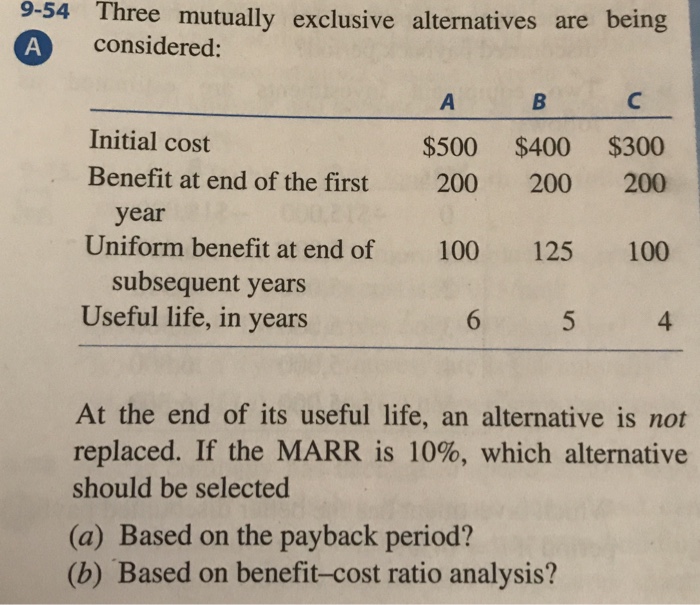

Question: 9-54 T ree mutually exclusive alternatives are being A considered: Initial cost Benefit at end of the first $500 $400 $300 200 100 6 200

9-54 T ree mutually exclusive alternatives are being A considered: Initial cost Benefit at end of the first $500 $400 $300 200 100 6 200 100 4 200 year Uniform benefit at end of 125 subsequent years Useful life, in years At the end of its useful life, an alternative is not replaced. If the MARR is 10%, which alternative should be selected (a) Based on the payback period? (b) Based on benefit-cost ratio analysis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock