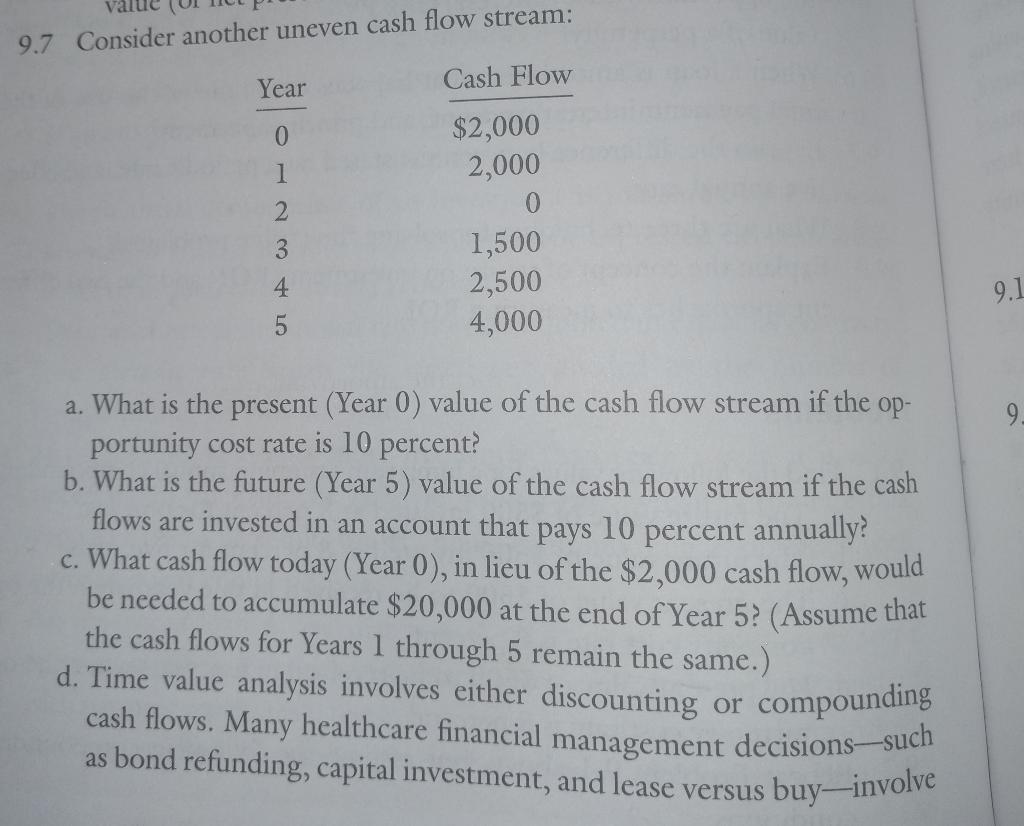

Question: 9.7 Consider another uneven cash flow stream: Year Cash Flow 0 1 2 cr A UN $2,000 2,000 0 1,500 2,500 4,000 9.1 9 a.

9.7 Consider another uneven cash flow stream: Year Cash Flow 0 1 2 cr A UN $2,000 2,000 0 1,500 2,500 4,000 9.1 9 a. What is the present (Year 0) value of the cash flow stream if the op- portunity cost rate is 10 percent? b. What is the future (Year 5) value of the cash flow stream if the cash flows are invested in an account that pays 10 percent annually? c. What cash flow today (Year 0), in lieu of the $2,000 cash flow, would be needed to accumulate $20,000 at the end of Year 5? (Assume that the cash flows for Years 1 through 5 remain the same.) d. Time value analysis involves either discounting cash flows. Many healthcare financial management decisionssuch as bond refunding, capital investment, and lease versus buy-involve or compounding Chapter 9: Time Value Analysis discounting projected future cash flows. What factors must execu- tives consider when choosing a discount rate to apply to forecasted cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts