Question: 978-0-525-57071-4 Section I: Answer question 1 and question 2 in Problem A. (55 min, 30 Marks) PROBLEM A CM owned by Mr Hammond and partners,

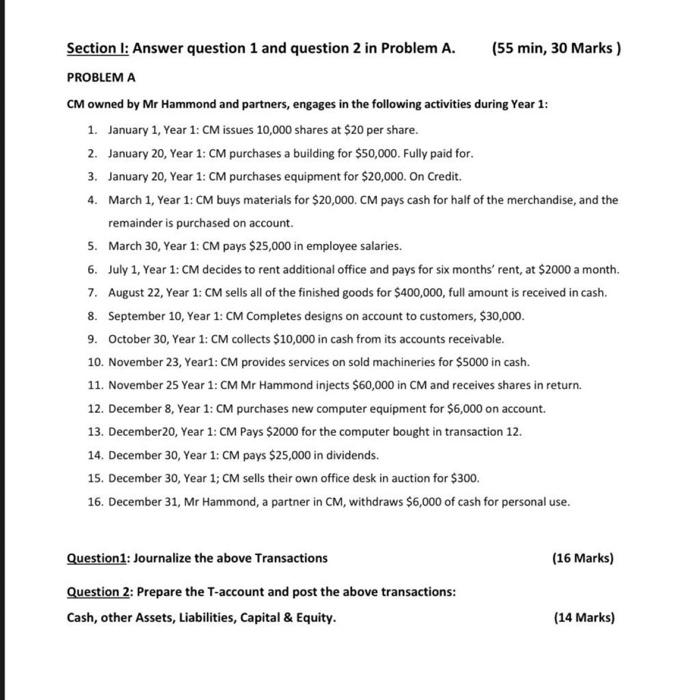

Section I: Answer question 1 and question 2 in Problem A. (55 min, 30 Marks) PROBLEM A CM owned by Mr Hammond and partners, engages in the following activities during Year 1: 1. January 1, Year 1: CM issues 10,000 shares at $20 per share. 2. January 20, Year 1: CM purchases a building for $50,000. Fully paid for. 3. January 20, Year 1: CM purchases equipment for $20,000. On Credit. 4. March 1, Year 1: CM buys materials for $20,000. CM pays cash for half of the merchandise, and the remainder is purchased on account. 5. March 30, Year 1: CM pays $25,000 in employee salaries. 6. July 1, Year 1: CM decides to rent additional office and pays for six months' rent, at $2000 a month. 7. August 22, Year 1: CM sells all of the finished goods for $400,000, full amount is received in cash. 8. September 10, Year 1: CM Completes designs on account to customers, $30,000. 9. October 30, Year 1: CM collects $10,000 in cash from its accounts receivable. 10. November 23, Yearl: CM provides services on sold machineries for $5000 in cash. 11. November 25 Year 1: CM Mr Hammond injects $60,000 in CM and receives shares in return. 12. December 8, Year 1: CM purchases new computer equipment for $6,000 on account. 13. December 20, Year 1: CM Pays $2000 for the computer bought in transaction 12. 14. December 30, Year 1: CM pays $25,000 in dividends. 15. December 30, Year 1; CM sells their own office desk in auction for $300. 16. December 31, Mr Hammond, a partner in CM, withdraws $6,000 of cash for personal use. Question1: Journalize the above Transactions (16 Marks) Question 2: Prepare the T-account and post the above transactions: Cash, other Assets, Liabilities, Capital & Equity. (14 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts