Question: 98% E52 Window Help Bookmarks People Tab 0 Fall: X mapps/assessment/take/launch.jsp?course_assessment id-158501.18&course_id-_659771&content id=2691946 Support Show Timer Question Completion Status: The project has an anticipated life

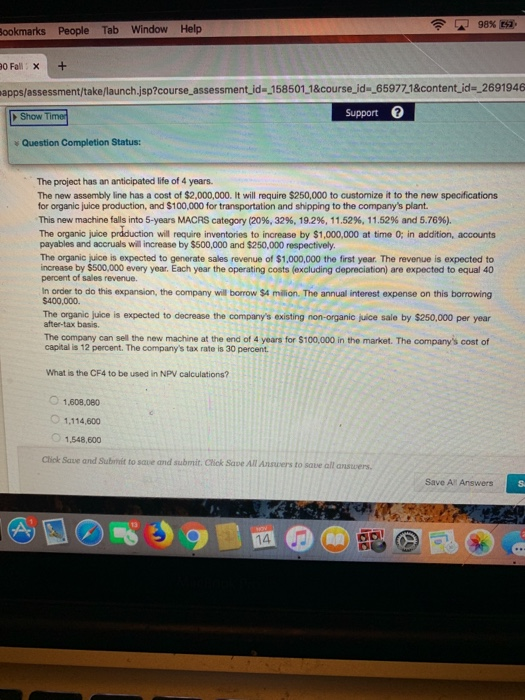

98% E52 Window Help Bookmarks People Tab 0 Fall: X mapps/assessment/take/launch.jsp?course_assessment id-158501.18&course_id-_659771&content id=2691946 Support Show Timer Question Completion Status: The project has an anticipated life of 4 years. The new assembly line has a cost of $2,000,000. It will require $250,000 to customize it to the new specifications for organic juice production, and $100,000 for transportation and shipping to the company's plant. This new machine falls into 5-years MACRS category (20 % , 32 % , 19.2 % , 11.52 % , 11.529 % and 5.76 % ) . The organic juice prdduction will require inventories to increase by $1,000,000 at time 0; in addition, accounts payables and accruals will increase by $500,000 and $250,000 respectively. The organic juice is expected to generate sales revenue of $1,000,000 the first year. The revenue is expected to increase by $500,000 every year. Each year the operating costs (excluding depreciation) are expected to equal 40 percent of sales revenue. In order to do this expansion, the company will borrow $4 million. The annual interest expense on this borrowing $400,000. The organic juice is expected to decrease the company's existing non-organic juice sale by $250,000 per year after-tax basis. The company can sell the new machine at the end of 4 years for $100,000 in the market. The company's cost of capital is 12 percent. The company's tax rate is 30 percent What is the CF4 to be used in NPV calculations? 1,608.080 1,114,600 1,548,600 Click Save and Subrit to sque and submit. Click Save All Ansuers to saue all answers. Save All Answers Sa 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts