Question: $9,924.44, 3.47 % . $9,511.21, 5.21 % . C. D. 30. Why do call options with exercise prices higher than the price of the underlying

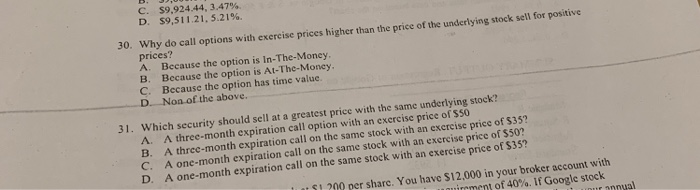

$9,924.44, 3.47 % . $9,511.21, 5.21 % . C. D. 30. Why do call options with exercise prices higher than the price of the underlying stock sell for positive prices? A. Because the option is In-The-Money, Because the option is At-The-Moncy. B. C. Because the option has time value. Non of the above. D. 31. Which security should sell at a greatest price with the same underlying stock? A three-month expiration call option with an exercise price of $50 B. A three-month expiration call on the same stock with an exercise price of $35? C A A one-month expiration call on the same stock with an exercise price of $50? D. A one-month expiration call on the same stock with an exercise price of $35? S1.200 per share. You have $12,000 in your broker account with irement of 40% . If Google stock r annual

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts