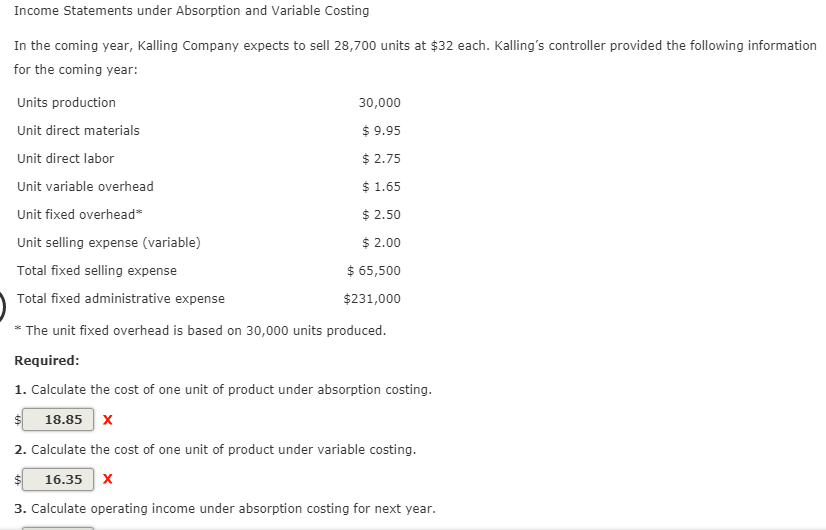

Question: $9.95 Unit direct materials Unit direct labor $ 2.75 $ 1.65 Unit variable overhead Unit fixed overhead Unit selling expense (variable) $ 2.50 $ 2.00

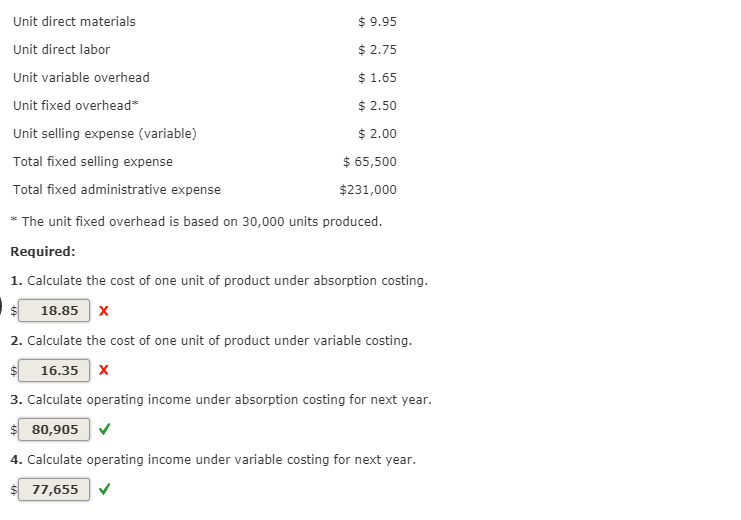

$9.95 Unit direct materials Unit direct labor $ 2.75 $ 1.65 Unit variable overhead Unit fixed overhead Unit selling expense (variable) $ 2.50 $ 2.00 $ 65,500 Total fixed selling expense Total fixed administrative expense $231,000 * The unit fixed overhead is based on 30,000 units produced. Required: 1. Calculate the cost of one unit of product under absorption costing. $C 18.85 2. Calculate the cost of one unit of product under variable costing. $ 16.35 x 3. Calculate operating income under absorption costing for next year. $ 80,905 4. Calculate operating income under variable costing for next year. $ 77,655

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts