Question: 9a. Blake Inc. needs 1,000,000 in 30 days. It can earn 5 percent annualized on a German security. The current spot rate for the euro

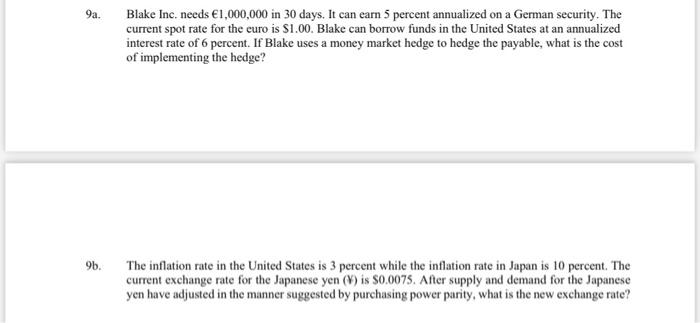

9a. Blake Inc. needs 1,000,000 in 30 days. It can earn 5 percent annualized on a German security. The current spot rate for the euro is $1.00. Blake can borrow funds in the United States at an annualized interest rate of 6 percent. If Blake uses a money market hedge to hedge the payable, what is the cost of implementing the hedge? 9b. The inflation rate in the United States is 3 percent while the inflation rate in Japan is 10 percent. The current exchange rate for the Japanese yen (V) is $0.0075. After supply and demand for the Japanese yen have adjusted in the manner suggested by purchasing power parity, what is the new exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts