Question: a. 0 c. Problem #1 Compute Pension Expense and Underfunding or Overfunding of the PBO; Entries Georgia Company has a noncontributory, defined benefit pension plan.

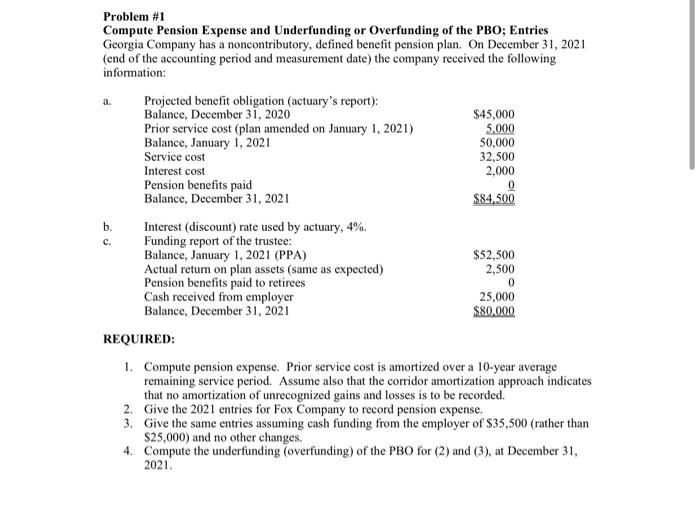

a. 0 c. Problem #1 Compute Pension Expense and Underfunding or Overfunding of the PBO; Entries Georgia Company has a noncontributory, defined benefit pension plan. On December 31, 2021 (end of the accounting period and measurement date) the company received the following information: Projected benefit obligation (actuary's report): Balance, December 31, 2020 $45,000 Prior service cost (plan amended on January 1, 2021) 5.000 Balance, January 1, 2021 50,000 Service cost 32,500 Interest cost 2,000 Pension benefits paid Balance, December 31, 2021 $84,500 b. Interest (discount) rate used by actuary, 4%. Funding report of the trustee: Balance, January 1, 2021 (PPA) $52,500 Actual return on plan assets (same as expected) 2,500 Pension benefits paid to retirees 0 Cash received from employer 25,000 Balance, December 31, 2021 $80.000 REQUIRED: 1. Compute pension expense. Prior service cost is amortized over a 10-year average remaining service period. Assume also that the corridor amortization approach indicates that no amortization of unrecognized gains and losses is to be recorded. 2. Give the 2021 entries for Fox Company to record pension expense, 3. Give the same entries assuming cash funding from the employer of $35,500 (rather than $25,000) and no other changes. 4. Compute the underfunding Coverfunding) of the PBO for (2) and (3), at December 31, 2021. a. 0 c. Problem #1 Compute Pension Expense and Underfunding or Overfunding of the PBO; Entries Georgia Company has a noncontributory, defined benefit pension plan. On December 31, 2021 (end of the accounting period and measurement date) the company received the following information: Projected benefit obligation (actuary's report): Balance, December 31, 2020 $45,000 Prior service cost (plan amended on January 1, 2021) 5.000 Balance, January 1, 2021 50,000 Service cost 32,500 Interest cost 2,000 Pension benefits paid Balance, December 31, 2021 $84,500 b. Interest (discount) rate used by actuary, 4%. Funding report of the trustee: Balance, January 1, 2021 (PPA) $52,500 Actual return on plan assets (same as expected) 2,500 Pension benefits paid to retirees 0 Cash received from employer 25,000 Balance, December 31, 2021 $80.000 REQUIRED: 1. Compute pension expense. Prior service cost is amortized over a 10-year average remaining service period. Assume also that the corridor amortization approach indicates that no amortization of unrecognized gains and losses is to be recorded. 2. Give the 2021 entries for Fox Company to record pension expense, 3. Give the same entries assuming cash funding from the employer of $35,500 (rather than $25,000) and no other changes. 4. Compute the underfunding Coverfunding) of the PBO for (2) and (3), at December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts