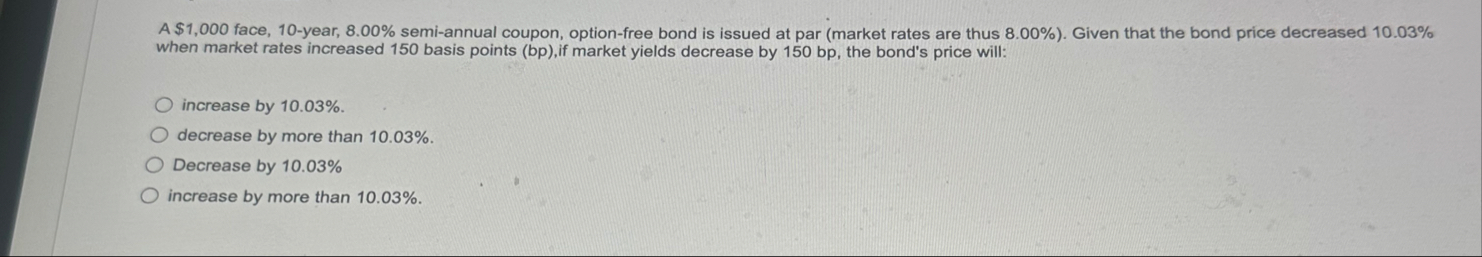

Question: A $ 1 , 0 0 0 face, 1 0 - year, 8 . 0 0 % semi - annual coupon, option - free bond

A $ face, year, semiannual coupon, optionfree bond is issued at par market rates are thus Given that the bond price decreased when market rates increased basis points bp if market yields decrease by bp the bond's price will:

increase by

decrease by more than

Decrease by

increase by more than

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock