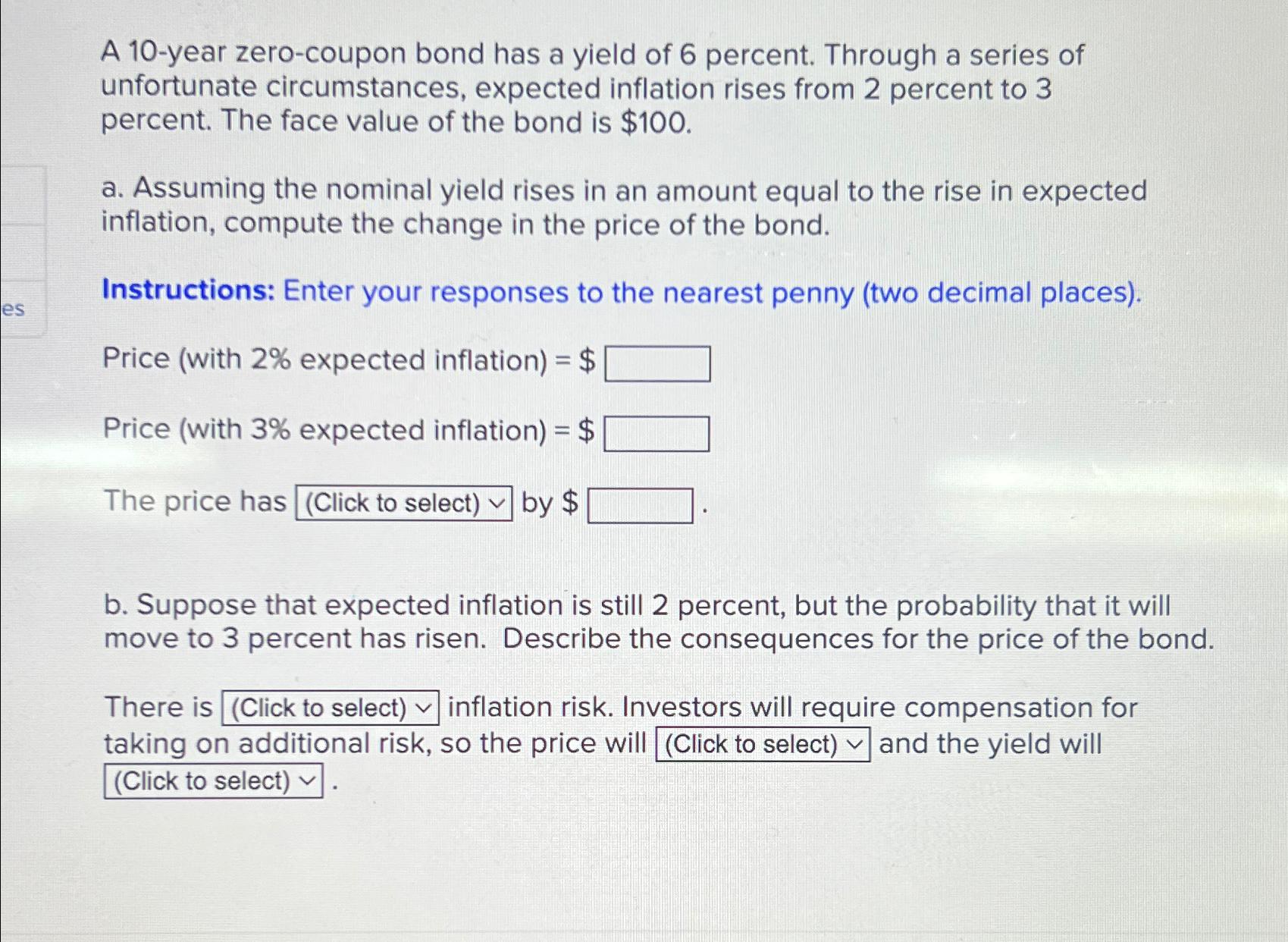

Question: A 1 0 - year zero - coupon bond has a yield of 6 percent. Through a series of unfortunate circumstances, expected inflation rises from

A year zerocoupon bond has a yield of percent. Through a series of unfortunate circumstances, expected inflation rises from percent to percent. The face value of the bond is $

a Assuming the nominal yield rises in an amount equal to the rise in expected inflation, compute the change in the price of the bond.

Instructions: Enter your responses to the nearest penny two decimal places

Price with expected inflation$

Price with expected inflation$

The price has Click to select by $

b Suppose that expected inflation is still percent, but the probability that it will move to percent has risen. Describe the consequences for the price of the bond.

There is Click to select inflation risk. Investors will require compensation for taking on additional risk, so the price will Click to select and the yield will Click to select

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock