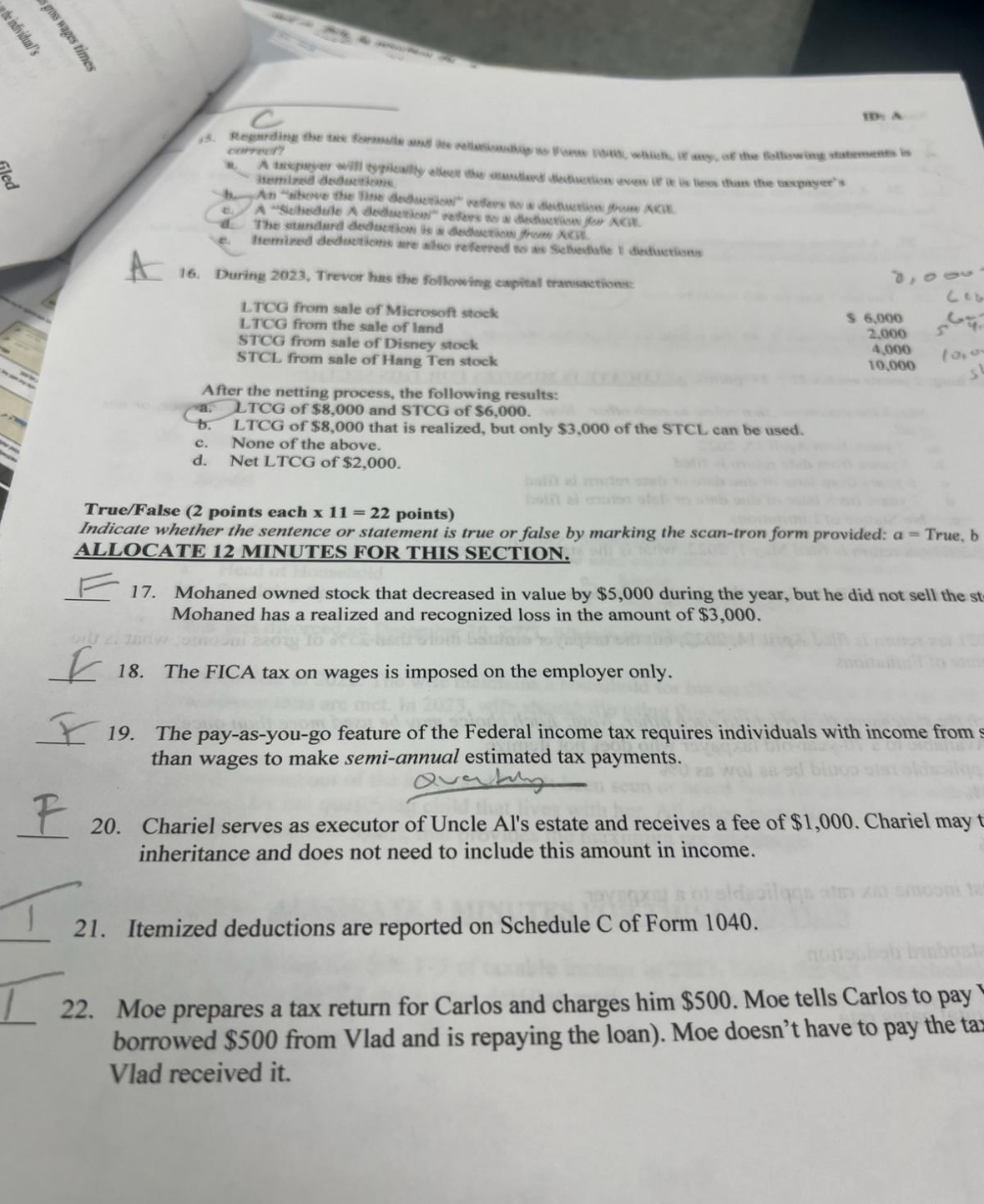

Question: A 1 6 . During 2 0 2 3 , Trevor has the following capital transactions: LTCG from sale of Microsoft stock LTCG from the

A

During Trevor has the following capital transactions:

LTCG from sale of Microsoft stock

LTCG from the sale of land

$

from sate of Disney stock

STCL from sale of Hang Ten stock

After the netting process, the following results:

a LTCG of $ and $ TCG of $

b LTCG of $ that is realized, but only $ of the $ can be used.

c None of the above.

d Net LTCG of $

TrueFalse points each points

Indicate whether the sentence or statement is true or false by marking the scantron form provided: True, b ALLOCATE MINUTES FOR THIS SECTION.

Mohaned owned stock that decreased in value by $ during the year, but he did not sell the st Mohaned has a realized and recognized loss in the amount of $

The FICA tax on wages is imposed on the employer only.

The payasyougo feature of the Federal income tax requires individuals with income from than wages to make semiannual estimated tax payments.

F

Chariel serves as executor of Uncle Al's estate and receives a fee of $ Chariel may inheritance and does not need to include this amount in income.

Itemized deductions are reported on Schedule C of Form

Moe prepares a tax return for Carlos and charges him $ Moe tells Carlos to pay borrowed $ from Vlad and is repaying the loan Moe doesn't have to pay the ta: Vlad received it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock