Question: A 1 8 - 8 Lessee Accounting; Amortization Table: ( LO 1 8 - 2 ) On 3 1 December 2 0 X 0 ,

A Lessee Accounting; Amortization Table: LO

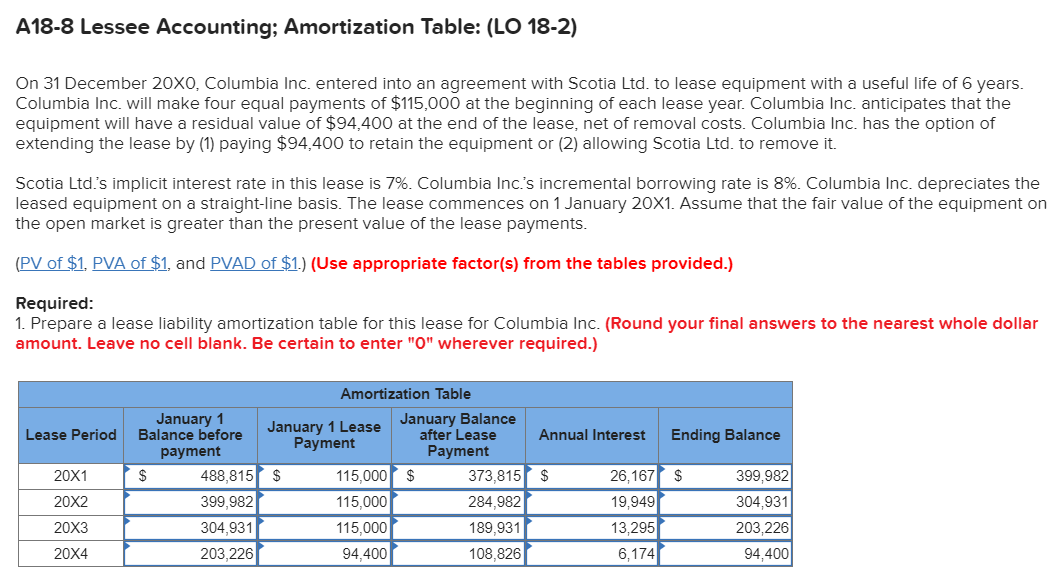

On December X Columbia Inc. entered into an agreement with Scotia Ltd to lease equipment with a useful life of years. Columbia Inc. will make four equal payments of $ at the beginning of each lease year. Columbia Inc. anticipates that the equipment will have a residual value of $ at the end of the lease, net of removal costs. Columbia Inc. has the option of extending the lease by paying $ to retain the equipment or allowing Scotia Ltd to remove it

Scotia Ltds implicit interest rate in this lease is Columbia Inc.s incremental borrowing rate is Columbia Inc. depreciates the leased equipment on a straightline basis. The lease commences on January X Assume that the fair value of the equipment on the open market is greater than the present value of the lease payments.

PV of $ PVA of $ and PVAD of $Use appropriate factors from the tables provided.

Required:

Prepare a lease liability amortization table for this lease for Columbia Inc. Round your final answers to the nearest whole dollar amount. Leave no cell blank. Be certain to enter O wherever required.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock